TCS to be levied above Rs 2 lakh only if payment in cash: CBDT

CBDT has issued a new circular clarifying that the Tax Collected at Source (TCS) levy will not be applicable when cash part of the payment for certain goods or services is less than Rs 2 lakh, even when the total payment is more than this amount.

Jun 27, 2016, 15:05 PM ISTPublicise blackmoney scheme at posh markets, malls: CBDT to IT

CBDT has directed the Income Tax department to step up publicity of the ongoing one-time blackmoney compliance window by advertising it at posh markets, clubs and showrooms and also ensure full privacy to those making disclosures for better collections.

Jun 23, 2016, 14:24 PM ISTEnsure single point contact for black money disclosures: CBDT

To ensure confidentiality, the Income Tax Department has mandated only senior officers to be a single point of contact for those making disclosures under the one-time window provided to black money holders to come clean.

Jun 23, 2016, 13:30 PM ISTRajasva Gyan Sangam: PM Modi asks tax officers to remove fear of harassment among taxpayers

Inaugurating the two-day Rajasva Gyan Sangam at Vigyan Bhavan today, PM Modi asked tax officers to move towards digitisation and make tax administration better and efficient.

Jun 16, 2016, 12:38 PM IST

PM Narendra Modi to inaugurate Rajasva Gyan Sangam today

Prime Minister Narendra Modi will hold an interactive session with the top brass of the two revenue collection arms of the government -- CBDT and CBEC -- during a first-of-its-kind 'Rajasva Gyan Sangam' on Thursday.

Jun 16, 2016, 08:45 AM IST

PM Modi to hold interactive session with taxmen at Revenue 'Gyan Sangam'

Prime Minister Narendra Modi will hold an interactive session with the top brass of the two revenue collection arms of the government -- CBDT and CBEC -- during a first-of-its-kind 'Rajasva Gyan Sangam' to be held here on June 16.

Jun 12, 2016, 10:51 AM ISTBlack money window: IT dept to publish list of asset valuers

The Income Tax department will soon put out a list of registered valuers of various categories of assets for those who wish to declare their untaxed funds and properties under the one-time domestic black money compliance window that opened Wednesday.

Jun 01, 2016, 23:06 PM ISTCompliance window for domestic black money opens tomorrow

Under the Income Declaration Scheme, persons making disclosure of unaccounted assets will be given time up to November 30 to pay taxes, penalty and surcharge totalling 45 percent at the fair market value.

May 31, 2016, 14:00 PM IST

FIs can obtain self-certification via internet banking: CBDT

Under the FATCA and CRS, Financial Institutions (FIs) can now obtain self-certification through internet banking platform from the user account where the customer has transaction rights, the CBDT said on Friday.

May 28, 2016, 18:04 PM ISTNot just cash transactions, IT officials also tracking Facebook posts for foreign tour photos!

IT officials are now tracking Facebook account of the offenders to dig out information from them.

May 22, 2016, 19:24 PM ISTIT dept's PAN-Aadhaar linkage crosses 50-lakh mark

The Income Tax department's ambitious plan to link its PAN number database with Aadhaar has crossed the 50-lakh mark.

May 11, 2016, 18:44 PM IST

CBDT sets August 31 as deadline for clearing pending ITRs, refunds

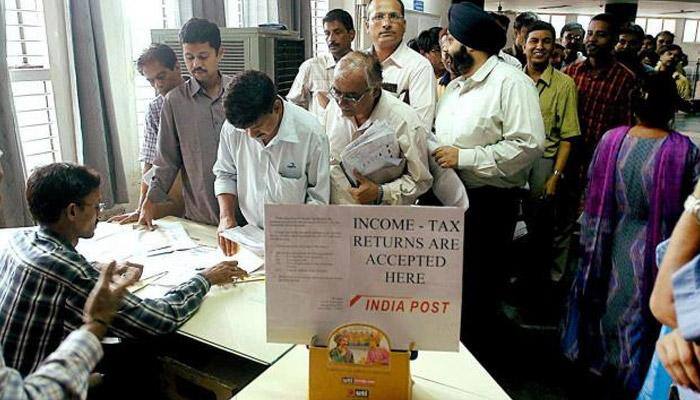

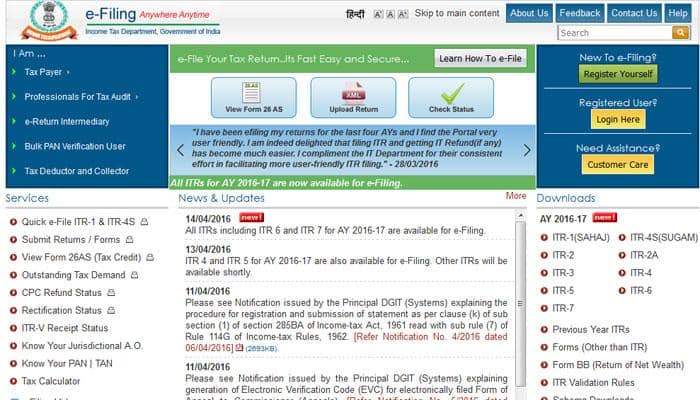

Taxpayers have been advised to check their status of pending returns for the said AYs at the IT department website for e-filing -- http://incometaxindiaefiling.Gov.In/. They can log in by using their PAN number and specific year of assessment.

May 09, 2016, 23:51 PM ISTIncome Tax refunds worth Rs 1.22 lakh crore issued in FY’16: Govt

The Income Tax department has issued 2.10 crore refunds totalling over Rs 1.22 lakh crore in 2015-16, which saw 94 per cent the returns being filed online.

May 06, 2016, 15:05 PM ISTJust 1% of population pay taxes; over 5,000 paid more than Rs 1 crore

Taxpayers account for just about one per cent of India's population, but tax outgo was over Rs 1 crore for as many as 5,430 individuals, as per the latest data disclosed by the government for assessment year 2012-13.

May 01, 2016, 17:45 PM ISTAll ITRs activated for e-filing: IT Dept

E-filing of income tax return for all category of filers for the assessment year 2016-17 has been operationalised.

Apr 15, 2016, 20:42 PM IST

India not to use 'tax haven' in black money info dossiers

Indian investigating agencies have been asked to shun the usage of the word "tax haven" while making legal overseas requests in black money cases as a number of foreign jurisdictions have taken exception to the term and called it offensive.

Apr 14, 2016, 18:06 PM IST

Panama Papers leak: India to take part in special OECD meet in Paris today

India will take part in a special OECD meet on Wednesday in Paris to firm up cooperation between countries in the wake of the 'Panama Papers' leak that has seen the government here order a multi-agency probe after 500 Indians were named in it as holding offshore assets in the tax haven.

Apr 13, 2016, 08:58 AM IST

Strict investigation is going on in Panama Papers leak, says Jayant Sinha

A strict investigation into 'Panama Papers' is on to find out if illegal activities have taken place in overseas Indian accounts, while full force of law has been applied to deal with 'wilful default' cases like that of Vijay Mallya, the Finance Ministry said on Monday.

Apr 11, 2016, 15:38 PM IST