Panama Papers: Probe to be under new anti-black money law

The monitoring and investigation into the cases of 500 Indians being named in the leaked 'Panama Papers' will be conducted under the stringent provisions of the new law to combat the menace of black money generated by Indians in foreign shores.

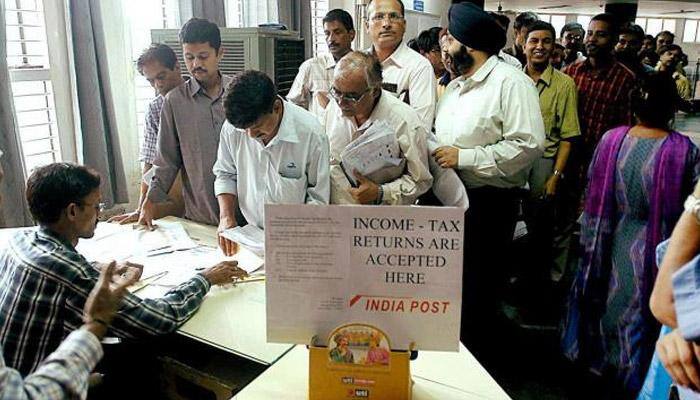

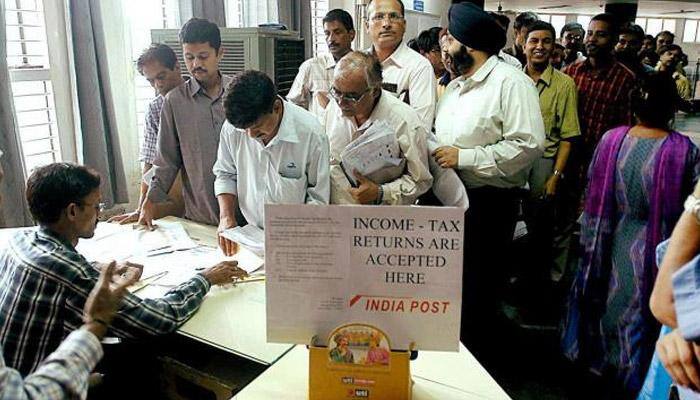

Apr 04, 2016, 21:01 PM ISTTax Dept issues refunds of over Rs 1.17 lakh crore

Income-tax Department issued tax refunds of over Rs 1.17 lakh crore in the last financial year ended March 31, of which Rs 37,870 crore was done in an automated manner.

Apr 04, 2016, 15:35 PM IST3-yr insurance after job cessation on cards for EPFO members

Retirement fund body EPFO is likely to approve tomorrow a proposal to provide insurance cover to its subscribers for three years after cessation of employment

Mar 28, 2016, 21:59 PM ISTDisclose correct details of interest income in ITR: CBDT

The revenue department on Wednesday asked taxpayers to file correct details of interest received from term deposits for the assessment year 2014-15 on or before March 31, while filing their Income Tax returns (ITRs).

Mar 23, 2016, 19:51 PM IST

CBDT eases taxation norms for bonds, debentures held by companies

Seeking to simplify the procedure and promote ease of doing business, CBDT has said capital gains tax will be computed from the date of acquisition of financial instruments like bonds and debentures and not from the date of their conversion into shares.

Mar 22, 2016, 15:44 PM ISTCBDT halves refunds issue timeline to 15 days for this fiscal

Concerned over the rising cases of refund-related grievances of the tax-paying public, CBDT Monday issued fresh directions to the Income Tax Department asking it to process all such cases, pending this fiscal, within 15 days instead of the stipulated 30 days.

Mar 07, 2016, 21:07 PM ISTCBDT sets up dedicated structure for delivery, monitoring of tax payer services

Grievance redressal is a major aspect of citizen centric governance and is an important feature of the activities of the Income Tax Department

Mar 07, 2016, 17:38 PM ISTGAAR: CBDT says no unfettered powers given to tax officers

CBDT has said the taxman has not been given any "unfettered" power and adequate safeguards have been deployed for regulating the provisions aimed to check tax evasion from overseas locations.

Mar 02, 2016, 21:52 PM ISTNow e-file your appeal before taxman; CBDT notifies new form

In yet another step aimed at reducing interface between taxman and the taxpayer, CBDT has notified a new form for e-filing the first appeal before a designated department officer.

Mar 02, 2016, 19:58 PM ISTTax demand on Vodafone, Cairn cannot be disputed: CBDT

CBDT Chairman Atulesh Jindal said "as long as" the retrospective amendment of the IT Act passed by Parliament remains valid, the "demand (of tax against them) remains valid."

Mar 01, 2016, 17:36 PM ISTCBDT resolves Rs 5,000-cr tax dispute with foreign cos under MAP

The tax department has resolved disputes involving Rs 5,000 crore with foreign companies in sectors like software and consultancy under the MAP scheme in past two years, a development that could provide comfort to overseas investors over taxation issues.

Feb 16, 2016, 22:44 PM ISTBlack money: CBDT asks I-T dept to speed up overseas requests

With the current financial year coming to a close soon, CBDT has asked the Income Tax department to speed up select black money and tax evasion probe cases which require cooperation from foreign agencies under existing bilateral treaties.

Feb 08, 2016, 22:30 PM ISTNew software for filing digitally signed I-T returns

Taxpayers had recently reported that they faced issues in using the Digital Signature Certificate at the time of uploading their Income Tax Returns.

Jan 26, 2016, 18:32 PM ISTAtulesh Jindal appointed new CBDT chief

Senior revenue service officer Atulesh Jindal was Thursday appointed Chairman of Central Board of Direct Taxes (CBDT), the apex policy making body of Income Tax department.

Jan 21, 2016, 23:16 PM ISTI-T department to issue over 64,000 refunds to small taxpayers by month-end

As per an official data, the Central Board of Direct Taxes (CBDT) has asked the taxman to issue refunds in a total of 64,938 pending cases involving Rs 1,148.14 crore, by January 31.

Jan 17, 2016, 13:14 PM ISTTax officers to raise only specific queries in scrutiny: Adhia

Seeking to eliminate corruption and promote ease of doing business, the revenue department has asked field offices only to raise specific queries in income tax assessment cases picked up for scrutiny.

Dec 30, 2015, 17:06 PM ISTExpedite scrutiny cases below Rs 5 lakh: CBDT to taxman

In fresh moves to end taxpayers grievances, CBDT has asked the taxman to "expeditiously" complete those scrutiny cases where income concealed is uptoRs 5 lakh .

Dec 30, 2015, 16:27 PM ISTScrutiny notice to seek specific details from taxpayers: CBDT

CBDT has asked its field offices to make sure the assessment notice should contain details of specific information or documents to be furnished by the assessee.

Dec 30, 2015, 16:04 PM ISTHuge income tax relief! No HC appeal for monetary limit below Rs 20 lakh

The monetary limit for filing appeals or Special Leave Petitions in the Supreme Court have been kept unchanged at Rs 25 lakh.

Dec 14, 2015, 12:05 PM ISTEmail project between Income Tax department, taxpayer delayed

The rollout of an ambitious pilot project of Income Tax department to begin paperless and email-based communication with taxpayers has been delayed as many chosen tax offices have not sent the required data to the CBDT even after over a month-and-a-half of the go-ahead.

Dec 13, 2015, 13:18 PM IST