CBDT introduces e-PAN, issues PAN within a day!

The Income Tax department on Tuesday said it has issued Permanent Account Number (PAN) within a day to 19,704 newly incorporated companies till March 31, 2017.

Apr 11, 2017, 15:07 PM ISTBan on cash dealings not applicable for bank, post office withdrawals

Ban on cash transaction in excess of Rs 2 lakh will not be applicable to withdrawals from banks and post office savings accounts, the income tax department said on Wednesday.

Apr 05, 2017, 20:57 PM ISTE-filing for two ITRs launched by I-T dept

The Income Tax department today launched the e-filing facility for select Income Tax Returns (ITRs) for the assessment year 2017-18.

Apr 01, 2017, 13:42 PM ISTDisclose deposits of Rs 2 lakh or more post note ban in new ITR forms

Taxpayers who deposited Rs 2 lakh or more post demonetisation, will have to make this disclosure in the new Income Tax Returns (ITRs) forms notified on Friday.

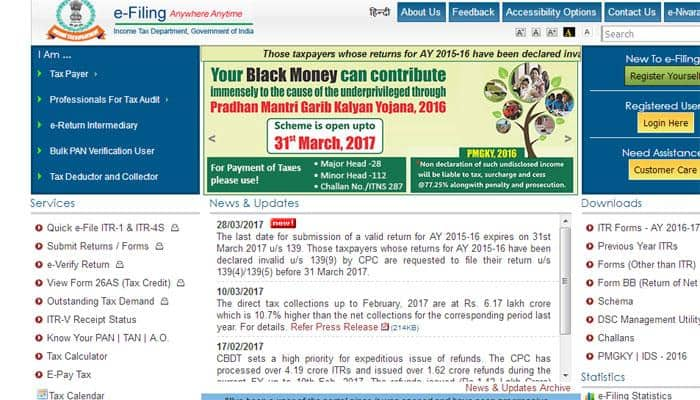

Mar 31, 2017, 16:32 PM ISTCBDT to hold review meeting on PMGKY, tax collection on Mar 17

The CBDT will hold a high-level meeting later this week to review the progress in collections under the black money window of Pradhan Mantri Garib Kalyan Yojna (PMGKY), that will close on March 31.

Mar 15, 2017, 20:42 PM IST206 delisted political parties not traceable: Government

The government today said out of 255 deregistered political parties, as many as 206 are either non-existent or non-traceable.

Mar 15, 2017, 20:12 PM ISTFast track prosecution cases against shell companies: CBDT to taxmen

As the noose tightens around shell companies evading taxes, the CBDT Chairman has asked field officers to file prosecution cases against those entities which claimed bogus long-term capital gains.

Mar 12, 2017, 11:36 AM ISTMonitor tax collection to meet target by Mar 31: CBDT to taxman

The CBDT has directed the Income Tax department to "scrupulously" monitor tax collection, which it said is slightly less than the target even as the current financial year is nearing an end.

Mar 07, 2017, 17:11 PM ISTShell companies under our radar: CBDT chief

The Central Board of Direct Taxes (CBDT) is examining several dubious companies and they would be removed from the website of Ministry of Corporate Affairs (MCA) if found to be shell firms.

Mar 04, 2017, 12:48 PM ISTTaxman to scrutinise loan deposits under op 'clean money'

The Income Tax department may initiate penal action and impose an equivalent penalty in select cases of loan amount deposits of Rs 20,000 or more as part of the 'Operation Clean Money' to check stash post demonetisation.

Feb 22, 2017, 20:10 PM ISTTDS default: I-T dept issues over 850 prosecution notices

The Income Tax department has issued over 850 prosecution notices to firms in the private and government domain in Karnataka and Goa on charges of delay in remitting TDS funds to the exchequer.

Feb 22, 2017, 15:36 PM ISTDemonetisation: I-T dept to strictly take on depositors of unverified cash over Rs 5 lakh

Depositors of cash worth Rs 5 lakh or above, during the demonetisation period, who failed to verify the same will be taken on strictly by the Central Board of Direct Taxes (CBDT)

Feb 22, 2017, 10:15 AM ISTNo amnesty for bank deposits linked to money laundering: CBDT

Any bank account suspected to have been "misused" for money laundering or shell company operations won't be exempted from probe under 'Operation Clean Money' despite having low deposits.

Feb 21, 2017, 20:53 PM ISTOperation Clean Money: No threat or show cause to taxpayers, CBDT tells taxman

The CBDT on Tuesday asked the taxman to ensure there is no "threat, warning or show cause" notice to taxpayers contacted by it under 'Operation Clean Money' that is aimed at checking black money post-note ban.

Feb 21, 2017, 19:43 PM IST

Know how you can get PAN within minutes, pay taxes via mobile app

People will soon be able to pay taxes and track their returns through a smartphone app and get a new PAN within minutes using Aadhaar verification.

Feb 15, 2017, 16:59 PM ISTOnline I-T grievance redressal facility launched at 60 offices

After launching the ambitious e-nivaran facility for online redressal of taxpayers' grievances, the Income Tax Department has now opened these windows at its 60 special offices across the country.

Feb 15, 2017, 15:25 PM ISTSoon you will receive PAN in few minutes, pay income tax using smartphone

In the latest addition to the list of measures taken by the government to make filing of taxes easy for the taxpayers, the Central Board of Direct Taxes (CBDT) is working on a plan to issue PAN in just few minutes using Aadhaar's e-KYC facility.

Feb 15, 2017, 12:49 PM ISTCBDT to taxman: Step up TDS survey ops to boost collections

With the current financial year inching towards closure, CBDT has directed the taxman to step up survey operations to check non-deduction of TDS by firms and employers, especially in cases where such payments have dropped by more than 15 percent as compared to last time.

Feb 10, 2017, 13:06 PM ISTCBDT issues certificates of appreciation to nearly 3.74 lakh tax payers

The total number of certificates issued by CBDT now stands at approximately 23 lakh.

Feb 08, 2017, 13:18 PM ISTCAs to pay fine of Rs 10,000 for filing incorrect info: CBDT

In a bid to check filing of incorrect returns by CAs, the tax authority will impose Rs 10,000 fine on such professionals to deter such act.

Feb 07, 2017, 20:36 PM IST