CBDT simplifies procedure for filling 15G, 15H forms

Forms 15G and 15H are filed by persons whose incomes are below the taxable threshold, to seek exemption from TDS on interest income.

Sep 30, 2015, 16:17 PM ISTPeople with Rs 4 lakh income, mofussil residents on IT radar: CBDT

Those earning Rs 4 lakh per annum, besides people in tier-II and tier-III cities with taxable income but not paying taxes are on the radar of the Income Tax department which has launched an ambitious drive to net one crore new assesses this financial year.

Sep 27, 2015, 10:08 AM ISTBlack money: Only Rs 2,000 crore declared by 29 people yet

Zee Media Bureau

Sep 25, 2015, 11:12 AM ISTCBDT to issue pre-filled ITR forms to ease e-filing

As part of efforts to popularise the electronic mode of filing Income Tax Returns (ITRs), the CBDT is planning to provide "pre-filled" return forms to filers which will have an automatic upload of data on income and other vitals of a taxpayer.

Sep 24, 2015, 16:32 PM ISTGovt not to extend Sept 30 deadline to disclose foreign assets

Government will not extend the deadline for income tax assesses to disclose unaccounted foreign assets abroad beyond September 30, which is the expiry date of the three-month compliance window to avoid punitive action, a senior tax official said Tuesday.

Sep 22, 2015, 15:56 PM IST

I-T dept to catch hold of black money holders post Sep 30: CBDT

All "consequences" of law will follow and the taxman will go after black money hoarders who do not declare their illegal funds before the expiry of a one-time 90-day 'compliance window' on September 30, the CBDT chief warned on Monday.

Sep 21, 2015, 15:35 PM IST

Sebi widens black money probe; offshore arbitrage under lens

Widening its probe into suspected tax evasion and laundering of black money through stock markets, regulator Sebi is looking into illicit 'arbitrage' through derivatives trading from offshore locations.

Sep 20, 2015, 15:22 PM ISTCorporate tax exemptions with sunset clauses may not be renewed

In order to phase out exemptions and move to lower corporate tax rate, the CBDT is considering not to renew tax exemptions after expiry of sunset clause.

Sep 10, 2015, 19:54 PM ISTCBDT asks officials not to pursue pending MAT cases

Days after the government decided to exempt foreign funds from tax on profits earned before April 1, the CBDT on Thursday issued a circular asking its fields officers to keep in abeyance pending assessments and not to recover any outstanding demand.

Sep 03, 2015, 12:43 PM ISTCBDT to soon issue instructions on MAT issue

With the Justice A P Shah panel recommending non-applicability of Minimum Alternate Tax (MAT) on FIIs, the revenue department is likely to soon issue instructions to field officer not to pursue pending cases against foreign institutional investors.

Sep 01, 2015, 19:25 PM ISTNo juniors, only senior I-T officials to depose before AAR: CBDT

In order to present the revenue side more effectively in high-value and important cases before the AAR judicial forum, CBDT has decided to stop the practice of sending junior-level Income Tax officials to these hearings and has ordered their seniors to take up the task.

Aug 19, 2015, 16:21 PM ISTCBDT to clarify on bank a/c disclosures under black money law

As per the rules released by the I-T department in July, CBDT had asked persons having undisclosed foreign bank accounts to provide sum total of credits since the opening of the account.

Aug 17, 2015, 16:07 PM ISTCBDT constitutes committee to fine tune transfer policy

In view of largescale cadre restructuring being effected in the Income Tax department recently, the CBDT has constituted a committee to review the existing transfer and posting policy in the organisation.

Aug 16, 2015, 20:42 PM ISTHave centralised monitoring for audit objections: CAG to CBDT

Government auditor CAG has suggested to the Central Board of Direct Taxes to introduce centralised monitoring mechanism to timely deal with the internal audit objections.

Aug 11, 2015, 22:30 PM ISTGovt assures 'full confidentiality' under black money window

This is in contrast to the Das' statement last week, where he had said that the information provided during the one-time compliance window can be revealed in the public interest.

Aug 10, 2015, 20:33 PM ISTFinMin to hold talkathon on new black money law Tuesday

Finance Ministry will hold a talkathon on the new black money law Tuesday during which Revenue Secretary Shaktikanta Das and CBDT Chairperson Anita Kapur will respond to the queries regarding the legislation.

Aug 03, 2015, 22:20 PM ISTIncome tax department notifies return forms for firms

The Central Board of Direct Taxes (CBDT) has notified tax returns forms for non-salaried class, including companies, partners in firms and individuals deriving their income from proprietary business or profession for 2015-16.

Aug 02, 2015, 22:33 PM ISTNew ITR forms for non-salaried individuals: Which form should you file?

The Income Tax department has notified the revised set of ITR forms for non-salaried individuals to file their returns for the assessment year 2015-16.

Aug 01, 2015, 12:40 PM ISTSmall bank licence: RBI asks I-T dept to verify applicants' credentials

CBDT has asked its investigation and regular assessment ranges across the country to "quickly" collect the data and submit them so that RBI can take a final view on the grant of licences to eligible parties.

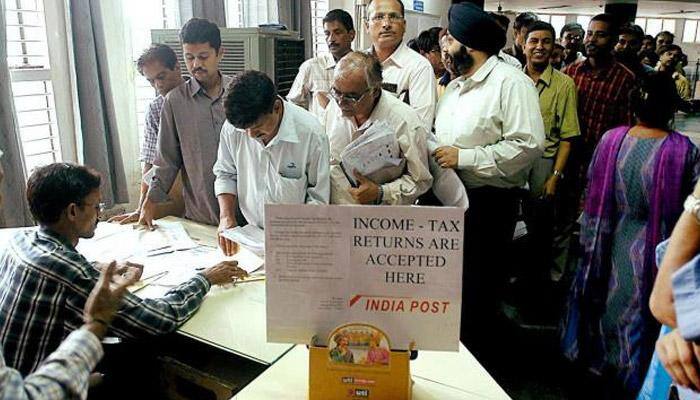

Jul 26, 2015, 11:32 AM ISTI-T dept to bring 1 crore new people under tax net this fiscal

The Income Tax department has launched an ambitious drive to bring under its net one crore new taxpayers after the government recently asked the taxman to achieve the target within the current fiscal.

Jul 19, 2015, 14:23 PM IST