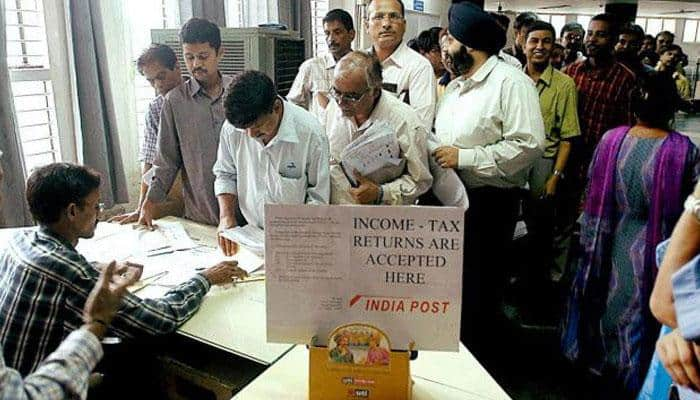

Income Declaration Scheme: I-T offices to remain open till midnight on Sept 30

The taxman will undertake a midnight vigil on September 30 as CBDT has directed the Income Tax department to keep their offices country-wide open in order to receive declarations under the domestic black money window - the Income Declaration Scheme (IDS).

Sep 15, 2016, 18:41 PM ISTCBDT to honour honest taxpayers

In a novel initiative revived after decades, the CBDT will soon honour lakhs of "honest and compliant" taxpayers from across the country who have paid their Income Tax dues diligently over the years.

Sep 15, 2016, 18:27 PM ISTIncome Declaration Scheme: I-T offices to remain open till midnight on Sep 30

The taxman will undertake a midnight vigil on September 30 as CBDT has directed the Income Tax department to keep their country-wide offices open in order to receive declarations under the domestic black money window - the Income Declaration Scheme (IDS).

Sep 15, 2016, 15:29 PM ISTGovt extends return filing date for large taxpayers to Oct 17

Revenue Department has extended the date to October 17 for filing of tax returns by assesses who are required to submit audited accounts in view of the ongoing income declaration scheme (IDS-2016).

Sep 09, 2016, 20:05 PM ISTCBDT launches online 'nivaran' to resolve I-T grievances

CBDT has launched the ambitious 'e-nivaran' facility for online redressal of taxpayers' grievances related to refunds, ITRs and PAN among others as part of its initiative to reduce instances of harassment of the public when it comes to complaints related to the I-T department.

Sep 08, 2016, 17:31 PM ISTGovt gives declarants option to come up with undisclosed income through e-filing

With just four weeks remaining for the black-money disclosure scheme to close, the government has given declarants an option to declare their undisclosed income through electronic filing rather than physical presentation of documents.

Sep 03, 2016, 11:54 AM ISTI-T dept to 'name and shame' chronic crorepati defaulters

The I-T department had began publishing the names of tax defaulters in leading national dailies last year and has so far named 67 such big defaulters from across the country.

Aug 29, 2016, 18:47 PM ISTIndia in talks with Singapore to amend DTAA provisions: CBDT

India is renegotiating over a two-decade old tax treaty with Singapore and the revised protocol will take into account the concerns of both.

Aug 23, 2016, 13:10 PM ISTBanning cash transactions over Rs 3 lakh under consideration: CBDT

Government is examining SIT's recommendation of banning cash transactions of over Rs 3 lakh in a bid to clamp down on black money in the economy, CBDT Chairperson Rani Singh Nair said Tuesday.

Aug 23, 2016, 13:02 PM ISTSIT's recommendation of banning cash transactions above Rs 3 lakh under consideration: CBDT

The Central Board of Direct Taxes (CBDT) on Tuesday said that the SIT's recommendation of banning cash transactions of Rs 3 lakh and above is under consideration.

Aug 23, 2016, 11:23 AM ISTBlackmoney disclosure:I-T dept not to question valuer's report

The valuation report from a registered valuer will not be questioned by the income tax department for disclosures made under the domestic black money compliance scheme, the CBDT clarified on Thursday.

Aug 18, 2016, 20:23 PM ISTCBDT to acknowledge black money declarants by August-end

Black money holders who have disclosed their ill-gotten assets during July under the ongoing compliance window will receive acknowledgement from the tax department by August 30.

Aug 14, 2016, 11:41 AM ISTCBDT issues draft norms for taxing buy back of unlisted shares

Central Board of Direct Taxes (CBDT) Monday came out with draft rules for determining the quantum of distributed income arising out of buy back of shares of unlisted companies for levy of tax.

Jul 25, 2016, 17:44 PM ISTCBDT prepares 9 lakh special cases; to confront taxpayers

The CBDT on Monday cautioned lurking stash holders saying it has prepared a database of about "nine lakh pieces" of instances of high-value transactions and it will soon "confront" them with this information as part of its exercise to ensure timely declarations under the ongoing one-time black money window.

Jul 18, 2016, 21:43 PM ISTIssue upto Rs 5,000 refunds fast and quick: CBDT to I-T dept

CBDT has directed the Income Tax department to "expeditiously" issue refunds worth Rs 5,000 for last three assessment years in order to provide immediate relief to taxpayers.

Jul 14, 2016, 20:14 PM ISTBlack money: Income Declaration Scheme is not a seasonal sale, says FM Jaitley

Refusing demands to make the Income Declaration Scheme 2016 more attractive, Finance Minister Arun Jaitley on Thursday said the IDS is "not a seasonal sale".

Jul 14, 2016, 19:10 PM IST

Black money window: CBDT issues notification to ensure secrecy

CBDT on Monday issued a fresh notification making it clear that information about those who declare their black money under the compliance window, ending September 30, will be kept secret.

Jul 11, 2016, 17:25 PM IST

Blackmoney window: CBDT orders rationing of taxman's leave

Pulling out all the stops to make the ongoing one-time black money window scheme a success, the CBDT has ordered regulation of leave of all Income Tax department officials over the next three months.

Jul 06, 2016, 18:46 PM ISTBlack money window: FM Jaitley to meet industry chambers, CAs today

Finance Minister Arun Jaitley will meet industry associations on Tuesday to clear doubts about the four-month window provided to holders of undeclared wealth to come clean.

Jun 28, 2016, 15:44 PM ISTBlack money window: CBDT issues fresh FAQs; PAN mandatory

CBDT on Monday issued a set of fresh FAQs to clarify doubts about the processes of the one-time black money window as it stated that furnishing PAN number will be mandatory for the declarant while cases of non-filing of ITRs will be eligible to apply but with certain conditions.

Jun 27, 2016, 21:55 PM IST