Direct tax revenue jumps 23.8 percent to Rs 8.98 lakh crore; net collection 52 percent above budget target

The tax department said that the growth rate for Corporate Income Tax (CIT) and Personal Income Tax (PIT) in terms of gross revenue collections stands at 16.73% and 32.30% respectively.

Oct 09, 2022, 15:56 PM ISTTax Audit Due Date Extension for AY2022-23 Latest Update: CBDT extends last day till October 7 after glitches in income tax portal

Tax Audit Due Date Extension for AY2022-23 Latest News: The CBDT has extended the due date by a week.

Oct 01, 2022, 08:33 AM ISTFM urges I-T officials to expedite returns, refund process and grievance redressal

There is a principle of equity in tax collections now, Sitharaman said, as direct tax collections have sustained the momentum along with indirect tax collections.

Sep 28, 2022, 13:06 PM ISTSukanya Samriddhi Yojana: Invest Rs 411 per day and get nearly Rs 66 lakh upon maturity, check payment calculation here

Account can be opened with a minimum of Rs 250 and Maximum Rs 1,50,000 in a financial year. Subsequent deposit in multiple of Rs 50. Deposits can be made in lump-sum No limit on number of deposits either in a month or in a Financial year.

Sep 28, 2022, 12:15 PM ISTFrom ITR to Form 16, AIS and 26AS, know ABC of Income Tax

Taxpayers often come across terms like Form 16 or 26AS, but a majority of them remain unaware of these terms.

Sep 27, 2022, 16:47 PM ISTGood news for taxpayers! Check how new Income Tax guidelines will benefit you

The Central Board of Direct Taxes (CBDT) has come out with revised guidelines for compounding of some offences under the Income Tax Act, 1961.

Sep 19, 2022, 09:06 AM ISTNational Pension Scheme: Want to get Rs 50K per month after retirement? Do THIS

This scheme not only gives the benefits of saving income tax but also guarantees a fixed amount every month after retirement from the job. If you invest in this scheme with proper guidance, you can easily arrange a pension of 50 thousand rupees every month.

Sep 12, 2022, 17:28 PM ISTED recovers Rs 11 lakh from Sanjay Raut, Rs 50 crore from Arpita Mukherjee: Know how much cash and gold you can keep at home without fearing income tax raids

The official raids conducted the by the agencies have ignited a lot of curiosity among people as to how much cash and gold one can keep in their houses/lockers.

Aug 02, 2022, 11:55 AM ISTITR Filing deadline ends: Take a look at the memes that ruled the internet

Notably, the ITR filing date has not been extended for the first time in three years.

Aug 01, 2022, 12:53 PM ISTITR Filing for financial year 2021-22: Facing issues with e-verification, legal heir registration, check THESE FAQs by Income Tax Dept

According to standard procedure, it takes 3–4 days for various banks to give the department information. After that, it is prefilled in the JSON for tax returns.

Jul 31, 2022, 09:58 AM ISTITR Filing for financial year 2021-22: Will Income Tax Return filing due date be extended today?

The government reported that as of Saturday at 8:36 p.m., more than 5 crore ITRs for the assessment year 2022–23 had been submitted.

Jul 31, 2022, 09:07 AM ISTITR Filing for financial year 2021-22: Filing ITR with multiple Form 16? Here’s how to do it

Form 16 is required for salaried individuals to file their ITR. It contains information about the Tax Deducted at Source (TDS) that the employer deducted and remitted on behalf of the employees during the fiscal year.

Jul 30, 2022, 11:33 AM ISTITR Filing for financial year 2021-22: 10 important documents required to file income tax return

Check out the top 10 documents you would need while filing income tax returns

Jul 29, 2022, 10:23 AM ISTAkshay Kumar becomes highest taxpayer in India, receives 'samman patra' from Income Tax

Directed by Aanand L Rai and written by Himanshu Sharma and Kanika Dhillon, the film is produced by Colour Yellow Productions, Zee Studios, Alka Hiranandani in association with Cape Of Good Films.

Jul 24, 2022, 22:32 PM IST5 advantages of filing ITRs on time: Here’s why you should submit income tax return before deadline

As per tax laws in India, it is mandatory to file your ITR or income tax returns because it serves as a form used to file information about your income and tax to the Income Tax Department.

Jul 21, 2022, 18:23 PM ISTAre you filing ITR? 5 mistakes you should avoid while filing income tax returns

The majority of these errors are the result of incorrect interpretation of tax regulations or ignorance.

Jul 16, 2022, 11:04 AM ISTFiled ITR for AY 2022-23? Top 5 things to keep in mind while filing income tax returns

Additionally, before submitting your ITR, you should gather any earnings and investment-related papers

Jul 10, 2022, 12:06 PM ISTCBI and I-T raid former NBCC officer's house in Noida

CBI and the Income Tax Department are conducting raids at the house of former NBCC officer D.K. Mittal in connection with the Prevention of Corruption Act.

Jul 09, 2022, 14:30 PM ISTCBI, I-T department raid former NBCC officer DK Mittal's home; recover Rs 2 crore

After the I-T team reached Mittal's house on Saturday morning, they counted the cash which turned out to be Rs 2 crore.

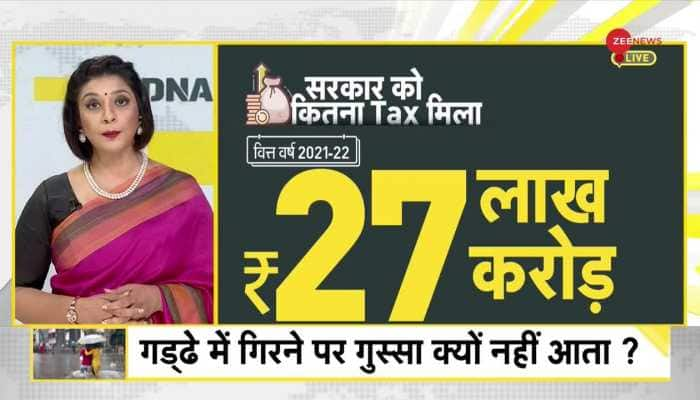

Jul 09, 2022, 13:35 PM ISTDNA: What facilities government has provided in lieu of taxes?

In the financial year 2021-22, the Government of India had received Rs 27 lakh crore as tax. Of these, Rs 14 lakh crore was received by the government in the form of direct tax and Rs 13 lakh crore in the form of indirect tax. But what facilities government has provided in return?

Jul 07, 2022, 01:42 AM IST