ITR Filing for financial year 2021-22: Filing ITR with multiple Form 16? Here’s how to do it

Form 16 is required for salaried individuals to file their ITR. It contains information about the Tax Deducted at Source (TDS) that the employer deducted and remitted on behalf of the employees during the fiscal year.

Jul 30, 2022, 11:33 AM ISTITR Filing for financial year 2021-22: 10 important documents required to file income tax return

Check out the top 10 documents you would need while filing income tax returns

Jul 29, 2022, 10:23 AM ISTAkshay Kumar becomes highest taxpayer in India, receives 'samman patra' from Income Tax

Directed by Aanand L Rai and written by Himanshu Sharma and Kanika Dhillon, the film is produced by Colour Yellow Productions, Zee Studios, Alka Hiranandani in association with Cape Of Good Films.

Jul 24, 2022, 22:32 PM IST5 advantages of filing ITRs on time: Here’s why you should submit income tax return before deadline

As per tax laws in India, it is mandatory to file your ITR or income tax returns because it serves as a form used to file information about your income and tax to the Income Tax Department.

Jul 21, 2022, 18:23 PM ISTAre you filing ITR? 5 mistakes you should avoid while filing income tax returns

The majority of these errors are the result of incorrect interpretation of tax regulations or ignorance.

Jul 16, 2022, 11:04 AM ISTFiled ITR for AY 2022-23? Top 5 things to keep in mind while filing income tax returns

Additionally, before submitting your ITR, you should gather any earnings and investment-related papers

Jul 10, 2022, 12:06 PM ISTCBI and I-T raid former NBCC officer's house in Noida

CBI and the Income Tax Department are conducting raids at the house of former NBCC officer D.K. Mittal in connection with the Prevention of Corruption Act.

Jul 09, 2022, 14:30 PM ISTCBI, I-T department raid former NBCC officer DK Mittal's home; recover Rs 2 crore

After the I-T team reached Mittal's house on Saturday morning, they counted the cash which turned out to be Rs 2 crore.

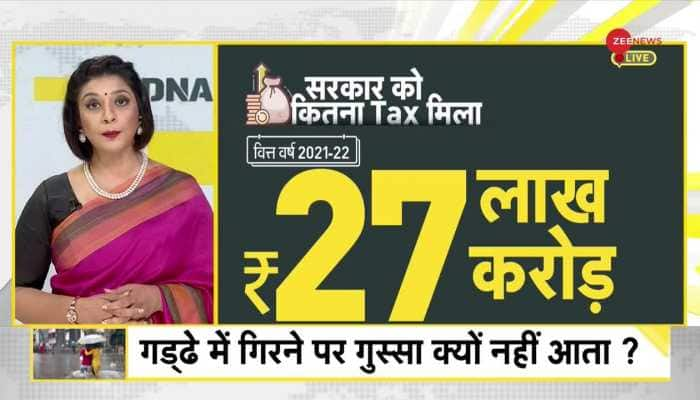

Jul 09, 2022, 13:35 PM ISTDNA: What facilities government has provided in lieu of taxes?

In the financial year 2021-22, the Government of India had received Rs 27 lakh crore as tax. Of these, Rs 14 lakh crore was received by the government in the form of direct tax and Rs 13 lakh crore in the form of indirect tax. But what facilities government has provided in return?

Jul 07, 2022, 01:42 AM IST'Received LOVE letter from...', Sharad Pawar BIG confession amid Maharashtra political crisis

Maharashtra political crisis: On receiving the income tax department's notice the day after the change of power, Pawar wrote on Twitter in Marathi that the help of ED and central agencies is now being taken. Several members of the assembly say they have received the notice.

Jul 01, 2022, 15:06 PM ISTNew TDS rule from 1 July 2022: How will it impact doctors, social media influencers? Top 5 things to know

The Budget brought in a new section, 194R, in the I-T Act which requires deduction of tax at source at the rate of 10 per cent by any person, providing any benefit or perquisite exceeding Rs 20,000 in a year to a resident, arising from the business or profession of such resident.

Jun 28, 2022, 15:43 PM ISTCrypto investors alert! TDS on virtual digital assets from July 1: Read CBDT guidelines on crypto tax

The Central Board of Direct Taxes (CBDT) issued an FAQ on the TDS provisions on virtual digital assets (VDA) or cyptocurrencies, which was introduced in 2022-23 Budget and will be effective from July 1.

Jun 23, 2022, 15:59 PM ISTPunjab: 20 people rounded up; weapons, cash seized from Mohali housing societies

The Punjab Police on Thursday said it rounded up 20 people and recovered seven weapons, reports PTI.

Jun 09, 2022, 20:26 PM ISTPan Card Update: Even if you are not 18 years old, you will get a PAN card, know how

Pan Card Update: Know the process of creating PAN card for those below 18 years of age.

Jun 02, 2022, 10:06 AM ISTED files chargesheet against Karnataka Congress chief DK Shivakumar

The case is based on an Income Tax Department charge sheet filed before a court for alleged tax evasion, reports IANS.

May 26, 2022, 18:48 PM ISTTaxpayers, ALERT! Income Tax Dept issues warning against fraud messages, check how to stay safe

PIB Fact Check cautioned the public on a new Income Tax lottery scam that could loot the accounts of taxpayers.

May 20, 2022, 12:41 PM ISTOnline tax dispute resolution scheme 2022 eliminates personal appearance: 5 big points you want to know

Here are 5 big points on elimination of personal appearance before the Dispute Resolution Committee laid out by the e-Dispute Resolution Scheme, 2022.

May 06, 2022, 18:10 PM IST4 major Income tax benefits given to Sukanya Samriddhi Account subscribers

The Sukanya Samriddhi Account gives major tax benefits to the subscribers. Here are four prominent ones:

Apr 22, 2022, 16:14 PM ISTLinking PF account with PAN can save you from TDS, here’s how

EPFO has created a new tax structure for PF contributions over a threshold of Rs 2.5 lakh for private-sector employees and Rs 5 lakh for government employees. The EPFO norms say that if TDS is less than Rs 5,000, there will be no deductions for Indian residents.

Apr 11, 2022, 13:02 PM IST8.4 lakh crore Income Tax dues outstanding; crores lying unclaimed with LIC: Finance Ministry

Over one crore individuals have outstanding income tax demand of over ₹8.40 lakh crore as on April 01, 2022, Finance Ministry informed Rajya Sabha on Tuesday. It also mentioned that over ₹21,000 crore was lying unclaimed with Life Insurance Corporation of India (LIC).

Apr 05, 2022, 19:32 PM IST