CBDT Signs Record 125 Pacts To Ease Tax Payments By Big Multinational Firms

With this, the total number of APAs since the inception of the APA programme has gone up to 641.

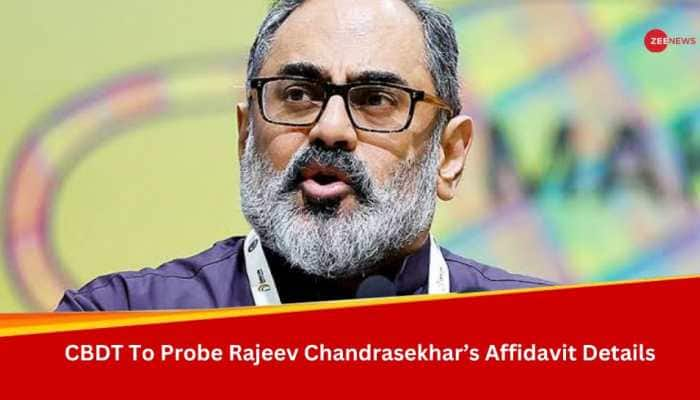

Apr 17, 2024, 08:01 AM ISTEC Orders CBDT To Probe Union Minister Rajeev Chandrasekhar’s Affidavit Details Over Congress Complaint

Union Minister Rajeev Chandrasekhar is a BJP candidate from Thiruvananthapuram Lok Sabha seat.

Apr 09, 2024, 14:18 PM ISTIncome Tax Alert: CBDT extends due date for filing Form 10B/10BB, ITR-7 till THIS Date

The CBDT circular has issued a curcular providing relaxation in respect of filing Form 10B/10BB, ITR-7 till THIS Date.

Sep 19, 2023, 09:07 AM ISTBIG Relaxation! CBDT Relaxes Rules For Valuing Rent-Free Accommodation By Employer, Know How It Will Impact You

The new rules will provide a major relief to top management players or high salaried employees in corporate as their take home salary will increase.

Aug 20, 2023, 14:39 PM ISTED Files Case Against BBC For Foreign Exchange Violations

The moves comes in the backdrop of the Income-Tax department surveying BBC office premises in Delhi in February.

Apr 13, 2023, 12:19 PM ISTIncome Tax: CBDT Notifies ITR Forms for Assessment Year 2023-24

ITR Form 1 (Sahaj) and ITR Form 4 (Sugam) are simpler forms that cater to a large number of small and medium taxpayers.

Feb 15, 2023, 14:17 PM ISTNew Tax Regime 2023: Revamped I-T Regime to Get 'Fabulous' Response, Says Income Tax Official

The new tax regime will be more beneficial for a person who does not have enough investments to claim I-T deductions.

Feb 03, 2023, 12:36 PM ISTBig ALERT for PAN holders! Your card will become inoperable if you don't do THIS thing before March 2023

As per Income-tax Act, 1961, it is mandatory for all PAN holders, who do not fall under the exempt category, to link their PAN with Aadhaar before 31.3.2023. From 1.04.2023, the unlinked PAN shall become inoperative.

Dec 24, 2022, 16:39 PM ISTIncome tax alert: Govt allows non-resident taxpayers to manually file Form 10F till March 31 for claiming TDS benefit

The Central Board of Direct Taxes (CBDT) had in July made it mandatory for non-resident taxpayers to file Form 10F electronically to claim benefit of lower Tax Deducted at Source (TDS).

Dec 16, 2022, 08:46 AM ISTTDS on salary: CBDT issues IMPORTANT circular on salary income, check details

The circular basically explains the obligation of employers with regard to the deduction of tax at source from salaries under section 192 of the Income-tax Act, 1961 for Financial Year 2022-23.

Dec 13, 2022, 12:53 PM ISTCBDT extends deadline for filing TDS for non-salary transactions till November 30

Form 26Q is used for quarterly filing of TDS returns on payments other than salary.

Oct 28, 2022, 14:41 PM ISTWill gift cards, reward points attract TDS on virtual digital assets? IT Dept issues clarification

The new rules for TDS on virtual digital assets and cryptocurrencies for transactions exceeding Rs 10,000 became effective today (July 1).

Jul 01, 2022, 14:12 PM ISTNew TDS rule from 1 July 2022: How will it impact doctors, social media influencers? Top 5 things to know

The Budget brought in a new section, 194R, in the I-T Act which requires deduction of tax at source at the rate of 10 per cent by any person, providing any benefit or perquisite exceeding Rs 20,000 in a year to a resident, arising from the business or profession of such resident.

Jun 28, 2022, 15:43 PM ISTHaven’t filed ITR? Get ready to face higher TDS, lower in-hand salary

You could face a higher TDS if you income tax return (ITR) for the financial year 2020-21.

May 19, 2022, 19:33 PM ISTPAN-Aadhaar not linked yet? Here's what you have to do now

The recent notification issued by the Central Board of Direct Taxes, or CBDT, states that failing to link Aadhaar and PAN results in a punishment of up to Rs 1,000.

Apr 03, 2022, 09:57 AM ISTPAN-Aadhaar Linking before March 31; Here's what happens if you don't link PAN-Aadhaar

If you do not link your PAN to Aadhaar by March 31, you may face a slew of penalties.

Mar 26, 2022, 10:42 AM ISTIT dept detects Rs 224-crore undisclosed income after raids on Infra.Market

The searches were launched on March 9 at the firm's 23 premises in Maharashtra, Karnataka, Andhra Pradesh, Uttar Pradesh and Madhya Pradesh.

Mar 20, 2022, 22:34 PM ISTI-T dept has made highest tax collection in its history: CBDT Chairman

The net income tax collection numbers as on today is Rs 13.63 lakh crore which is against Rs 11.18 lakh crore of 2018-19.

Mar 17, 2022, 21:17 PM ISTITR Update: Income Tax refunds worth about Rs 1.83 lakh crore issued to 2.07 crore taxpayers

The income tax department said it has issued refunds of close to Rs 1.83 lakh crore to more than 2.07 crore taxpayers so far this fiscal.

Feb 24, 2022, 18:10 PM ISTTaxpayers alert! IT Dept asks taxpayers to complete THIS important work

More than 29.8 lakh Tax Audit Reports were filed on ITD’s e-filing portal as of 15th February 2022.

Feb 18, 2022, 16:28 PM IST