CBDT allows manual filing by resident, NRI taxpayers for nil or lower TDS certificate

The CBDT has also allowed resident applicants to file manual application in Form No. 13 before the TDS officer or in ASK Centers till December 31.

Dec 26, 2018, 13:56 PM ISTSubmit these documents to avoid paying excess TDS

Generally, an employer deducts tax from your salary and pay it to the government known as Tax Deducted at Source (TDS).

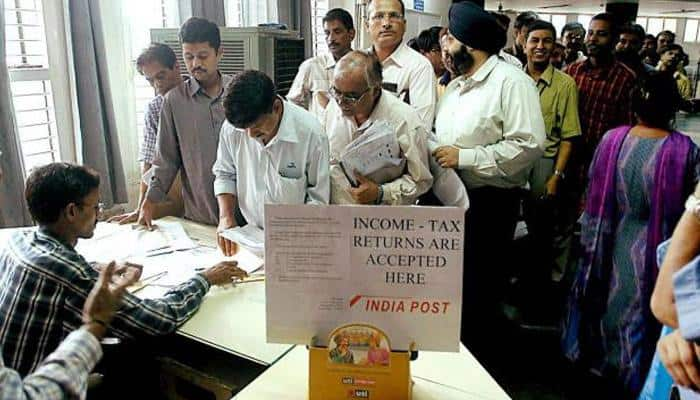

Jan 25, 2018, 10:43 AM ISTOnline I-T grievance redressal facility launched at 60 offices

After launching the ambitious e-nivaran facility for online redressal of taxpayers' grievances, the Income Tax Department has now opened these windows at its 60 special offices across the country.

Feb 15, 2017, 15:25 PM ISTCBDT to taxman: Step up TDS survey ops to boost collections

With the current financial year inching towards closure, CBDT has directed the taxman to step up survey operations to check non-deduction of TDS by firms and employers, especially in cases where such payments have dropped by more than 15 percent as compared to last time.

Feb 10, 2017, 13:06 PM ISTBudget 2017: Govt unveils string of measures towards Ease of Doing Business

Presumptive income scheme for audit of entities raised from Rs. 1 crore to Rs. 2 crore; Threshold for maintenance of books for individuals and HUF more than doubled.

Feb 01, 2017, 14:17 PM ISTHC junks Vodafone plea against IT demand of over Rs 7.5 crore

The Delhi High Court on Friday dismissed Vodafone's plea challenging a demand of over Rs 7.57 crore imposed on it by the Income Tax department for not deducting TDS for the assessment year 2013-14 on discount given to distributors towards sale of recharge coupons.

Jul 22, 2016, 18:45 PM ISTNo TDS on PF withdrawal: Key facts you must know

EPFO has issued a new circular circular which will make PF withdrawal tax free.

Jun 03, 2016, 11:00 AM ISTMust watch video: Good news! No TDS on PF withdrawal

Share Bazar, Mandi Live, Aap Ka Bazar, First Trade, Big Debate etc.

Jun 02, 2016, 10:52 AM ISTLearn about the ways to file income tax return

Return of income can be filed either in hard copy at the local office of the Income-tax Department or can be electronically filed at www.incometaxindiaefiling.gov.in

Apr 17, 2016, 18:33 PM ISTI-T emphasis on creating awareness on TDS

Income Tax department is emphasising on creating greater awareness on tax deducted at source (TDS) compliance.

Jan 31, 2016, 19:27 PM ISTEaswar panel on I-T for raising threshold for TDS deduction

A high level panel on simplification of income tax laws on Monday recommended raising the threshold limits for deduction of tax at source (TDS) as also slashing the rate of withholding tax.

Jan 18, 2016, 15:20 PM ISTTDS threshold to be increased; Know what are the benefits

TDS rates for interest income and commission need to be rationalized, the committee suggested that these should be halved to 5 percent.

Jan 18, 2016, 10:44 AM ISTI-T Dept simplifies online rectification of TDS in ITR

Aimed at making life easier for tax payers, the I-T department on Thursday said it simplified the process of online rectification of incorrect details of tax deducted at source (TDS) filed in the income tax return (ITR).

Dec 10, 2015, 17:59 PM IST

CBDT simplifies procedure for filling 15G, 15H forms

Forms 15G and 15H are filed by persons whose incomes are below the taxable threshold, to seek exemption from TDS on interest income.

Sep 30, 2015, 16:17 PM ISTSpiceJet says no default on TDS obligations

With a Delhi court summoning SpiceJet and its former executives in income tax cases, the budget carrier Wednesday said it has not defaulted on any tax-deducted at source (TDS) obligations.

Jul 22, 2015, 21:55 PM ISTCourt summons SpiceJet, Kalanithi Maran as accused in IT cases

Budget carrier SpiceJet Ltd, its Chairman Kalanithi Maran and another top company official have been summoned as accused by a Delhi court in two tax evasion cases for their alleged failure to deposit over Rs 147 crore TDS with the Income Tax (IT) Department.

Jul 21, 2015, 17:29 PM ISTGovt will have to forget direct tax of Rs 6.73 lakh crore

A paper presented during the recently held All India Conference of Chief Income Tax Commissioners stated that the department might recover 19% of Rs 8 lakh crore. But there's a rider: even this is going to be a 'tough task'.

Jun 08, 2015, 13:31 PM ISTI-T Dept issues detailed circular to address tax grievances

To address grievances of taxpayers, the I-T Department Tuesday put in place a detailed framework for 'verification and correction' of the outstanding tax demand, while rectifying the inaccuracies arising due to delayed or non-reporting of TDS (Tax Deduct at Source).

May 19, 2015, 23:22 PM ISTSome tax deductors not depositing TDS: I-T Dept

The Income Tax Department has taken note of some tax deductors not depositing TDS in the government account after deducting the same from specified payments.

May 12, 2015, 13:21 PM ISTI-T dept collects Rs 6.96 lakh cr revenue during 2014-15

The achieved collections are about Rs 9,000 crore or 14 percent short of the projected target of Rs 7,05,000 crore.

May 03, 2015, 15:59 PM IST