PM Narendra Modi launches Transparent Taxation platform for honest taxpayers

Unveiling the “Transparent Taxation – Honoring the Honest” platform through video conferencing, the prime minister also laid out the next phase of reforms of the direct taxes which is aimed at easing the tax compliance and also rewarding honest taxpayers in the midst of coronavirus (COVID-19) pandemic.

Aug 13, 2020, 12:12 PM ISTCBEC to be renamed CBIC by April 2018

Rechristening of the apex indirect tax policy-making body CBEC to Central Board of Indirect Taxes and Customs (CBIC) is likely to happen by April after the budgetary exercise gets Parliament nod.

Feb 04, 2018, 18:40 PM ISTGST's 17-year roller coaster ride to climax Friday midnight

After 17 tumultuous years, a nationwide Goods and Services Tax (GST) will rollout from Friday midnight, overhauling India's convoluted indirect taxation system and unifying the USD 2 trillion economy with 1.3 billion people into a single market.

Jun 30, 2017, 15:31 PM ISTModi's war on black money incomplete without taxing farm income

Amit Kapoor/IANS

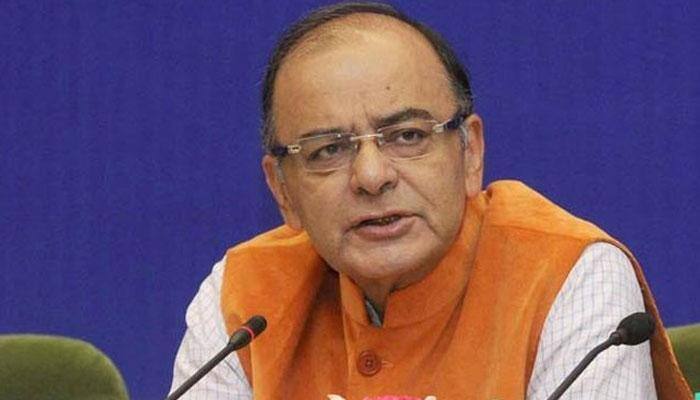

May 03, 2017, 00:08 AM ISTRaising tax could at times be a "retrograde" method: FM Jaitley

Government's intention is to increase the revenue base but raising the taxation level could at times be a "retrograde" method, Finance Minister Arun Jaitley said Friday.

Mar 17, 2017, 18:06 PM ISTTaxes under GST ''to increase a bit'', says CBEC Chairman

While the effective rate of indirect taxes under the new Goods and Services Tax (GST) regime still remains unclear, as fitment in tax slabs is under way, the Central Board of Excise and Customs (CBEC) has said that taxes were likely to "increase a bit" from the current level.

Mar 14, 2017, 11:24 AM ISTGST may fuel growth of domestic auto ancillary industry

The proposed GST implementation may fuel growth in the USD 39 billion domestic auto ancillary industry following lower taxation of 18 per cent under the new regime, industry experts said.

Mar 03, 2017, 20:48 PM ISTPM Modi assures middle class of an end to tax terrorism

"Middle class, upper middle class used to be hassled with I-T officers, more than police. I have to change this situation, I am working on it and will make the change happen," Modi said in his Independence Day address.

Aug 15, 2016, 08:51 AM ISTCBDT eases taxation norms for bonds, debentures held by companies

Seeking to simplify the procedure and promote ease of doing business, CBDT has said capital gains tax will be computed from the date of acquisition of financial instruments like bonds and debentures and not from the date of their conversion into shares.

Mar 22, 2016, 15:44 PM ISTArun Jaitley’s Union Budget 2016-17: Five Takeaways

Possibly too keenly aware of the BJP being seen as corporate friendly and, possibly, deriving lessons from the Bihar drubbing, the government has most conspicuously given an agri and rural push.

Feb 29, 2016, 19:18 PM ISTHow the Govt plans Simplification and Rationalization of Taxation

In order to reduce multiplicity of taxes, associated cascading and to reduce cost of collection, abolition 13 cesses, levied by various Ministries in which revenue collection is less than Rs.50 crore in a year, is proposed.

Feb 29, 2016, 14:21 PM ISTMake in India Week: PM Narendra Modi promises stable tax regime, more reforms

Modi said that India is probably the most open country for Foreign Direct Investment (FDI), which has increased by 48 percent since the BJP government came to power in May 2014.

Feb 13, 2016, 19:59 PM IST

IT Dept processes 3.27 cr returns during April-December

Income Tax Department has processed 3.27 crore returns and has issued refunds in 1.81 crore cases.

Jan 18, 2016, 15:17 PM ISTRetrospective tax law hurt India, scared away investors: FM Jaitley

Retrospective tax law has hurt the country as it scared away the investors, Finance Minister Arun Jaitley Saturday said and stressed on the need for maintaining the standards of fairness in taxation.

Jan 02, 2016, 20:05 PM ISTScrutiny notice to seek specific details from taxpayers: CBDT

CBDT has asked its field offices to make sure the assessment notice should contain details of specific information or documents to be furnished by the assessee.

Dec 30, 2015, 16:04 PM ISTHousing prices down 15-20%; no scope for further cut: CREDAI

Housing prices have fallen by an average 15-20 percent across the country in last 18 months and there is no scope for further reduction, realtors' apex body CREDAI said on Wednesday.

Dec 09, 2015, 17:05 PM IST'Ease of doing biz issues to affect US investments to India'

Problems related to ease of doing business such as taxation, regulatory burdens and legal issues can deter American investors from investing in India, US Ambassador Richard Verma said Thursday even as he hoped that the USD 500 billion bilateral trade target would be achieved.

Dec 03, 2015, 14:24 PM ISTAntim Baazi: Chances of passing the GST Bill

As the Parliamentary Winter session has commenced the topic of GST Bill will be discussed in the assembly soon. So check out this segment to know more.

Nov 26, 2015, 18:39 PM ISTGovt extends tenure of Lahiri Panel by 1 year

Government has extended by one year the tenure of a high level committee set up under former Chief Economic Advisor Ashok Lahiri to suggest steps to sort out taxation problem being faced by the trade and industry.

Nov 12, 2015, 16:12 PM ISTRational personal taxes, flat 25% corporate tax in 4 years: FM Jaitley

Rational personal taxes, flat 25% corporate tax in 4 years: FM Jaitley