HDFC Bank offers EMI relief to borrowers, cuts lending rate by 0.05%

Private sector HDFC Bank has cut lending rate by 0.05 percent, a move which will lower EMI for its new borrowers.

Jun 08, 2016, 19:46 PM ISTStand Up India Scheme to benefit at least 2.5 lakh SC/ST, women entrepreneurs

The Scheme envisages extending bank loans between Rs 10 lakh and Rs 1 crore for setting up greenfield enterprises by scheduled caste/scheduled tribe and Women entrepreneurs and also extending effective handholding support to them.

May 06, 2016, 18:25 PM IST

RBI proposes to regulate peer-to-peer lending sector

RBI on Thursday released a consultation paper on peer-to-peer (P2P) lending, in order to bring the sector under its purview, by proposing a minimum capital requirement of Rs 2 crore for the players and barring them from promising extraordinary returns.

Apr 28, 2016, 19:46 PM ISTRBI trims list of firms needing bad loan provisioning: Report

The RBI has dropped 20 companies including Jaiprakash Associates Ltd and Coastal Energen Pvt Ltd from the initial list of 150 firms for which banks were asked make provision.

Apr 21, 2016, 10:19 AM ISTLoan default: SC says big defaulters escape while farmers are penalised

The Supreme Court on Tuesday favoured making public the total amount of outstanding loans given by banks to various individuals and entities and running into lakhs of crores of rupees as per the information provided to it by RBI in a sealed cover.

Apr 12, 2016, 13:53 PM ISTSupreme court peruses RBI list of loan defaulters of over Rs 500 crore

The apex court further said it will examine if total amount of defaulted loans running in crores can be disclosed.

Apr 12, 2016, 12:56 PM ISTRBI sees 7.6% growth in FY17 on favourable monsoon

The Reserve Bank today said it expects the economy to grow by 7.6 percent in the current fiscal on the back of favourable monsoon, a notch lower than the upper end of government's range of 7-7.75 percent.

Apr 05, 2016, 15:27 PM ISTFirst RBI Monetary Policy Review of FY 16-17: Key Highlights

Know the key highlights of RBI's first bi-monthly monetary policy statement, 2016-17.

Apr 05, 2016, 12:30 PM ISTRBI Monetary Policy Review: Full Text

Read the full text of RBI's first Monetary Policy Review of financial year 2016-17.

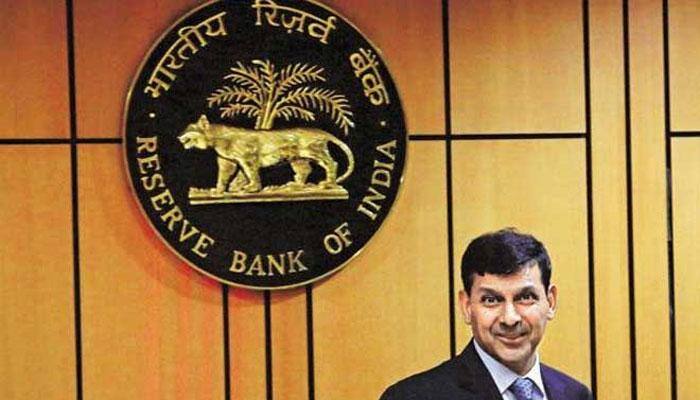

Apr 05, 2016, 12:22 PM ISTLIVE RBI Monetary Policy Review: Part of investigative team looking into Panama leaks, says Raghuram Rajan

Zee Media Bureau

The Reserve Bank of India on Tuesday slashed repo rate by 0.25 percent to 6.50 percent in its first bi-monthly monetary policy review.

Apr 05, 2016, 11:54 AM ISTRBI credit policy review: Raghuram Rajan surprises with hike in reverse repo rate

But in a surprise move, the RBI also raised the reverse repo - or the rates lenders charge to the central bank - by 25 basis points to 6.0 percent, while taking measures to ensure more availability of cash in the banking system.

Apr 05, 2016, 11:36 AM ISTRBI monetary policy: Raghuram Rajan cuts interest rate by 0.25%; auto, home loans to be cheaper

The Reserve Bank of India on Tuesday cut its policy rate by 0.25 percent while unveiling its first bi-monthly policy review for this fiscal, paving way for cheaper home and auto loans.

Apr 05, 2016, 10:43 AM IST

Sensex trips 125 points ahead of RBI policy

Domestic investors were cautious ahead of Reserve Bank's monetary policy meet as the market benchmark Sensex dropped over 125 points in early trade while Asian cues were muted on overnight losses in US and fall in oil prices.

Apr 05, 2016, 10:20 AM ISTRBI's credit policy review today: What to expect

The RBI is also expected to say that it is retaining its "accommodative" stance, raising the prospect of another 0.25 percent rate cut later this year.

Apr 05, 2016, 09:38 AM ISTRBI monetary policy review today: Raghuram Rajan likely to cut interest rate by 0.5%

RBI will unveil its first bi-monthly policy review for this fiscal Tuesday amid expectations of a 0.25-0.50 percent cut in interest rates to boost industrial growth and economy.

Apr 05, 2016, 08:58 AM IST

Fixed rate loans up to 3 years to be based on marginal cost: RBI

From next month, all banks will follow Marginal Cost of Funds based Lending Rate (MCLR) system, a new uniform methodology which will ensure fair interest rates to borrowers as well as to banks.

Mar 29, 2016, 20:14 PM ISTGovernment's big push to create entrepreneurs from SC/ST, women: FM Arun Jaitley

Asking party workers to reach out to SCs, STs and women, Finance Minister Arun Jaitley today said government will soon launch 'Stand Up India' scheme to provide loans of up to Rs one crore to help members of these communities become big entrepreneurs.

Mar 26, 2016, 19:18 PM ISTRBI revises liquidity measuring rules for Basel III

The Reserve Bank has revised certain rules on measuring liquidity for Basel III norms, providing exemption to branches of foreign banks from submitting statement with regard to foreign currency.

Mar 23, 2016, 20:00 PM IST

Retro tax settlement scheme to open from June 1

Government will open from June 1 its one-time offer to settle retrospective tax disputes involving firms like Vodafone and Cairn Energy after rules are framed for them to pay principal tax and get waiver from interest and penalty

Mar 20, 2016, 10:48 AM ISTSell assets of guarantors if firms don’t repay: Govt to banks

Issuing the directive to heads of PSBs, the Finance Ministry regretted that they seldom recover loan from guarantors in case of loan default by companies

Mar 19, 2016, 13:43 PM IST