Are you aware of this Income Tax campaign starting today? Know how it will impact you

The 11 days campaign ending on July 31 focuses on the assessees/taxpayers who are either non-filers or have discrepancies/deficiency in their returns for the FY 2018-19.

Jul 20, 2020, 14:59 PM ISTIncome Tax returns deadline extended to September 15 for flood-hit Kerala

Income Tax assessees in Kerala can now file their I-T returns till September 15.

Aug 28, 2018, 21:20 PM ISTNew ITR forms for 2018-19 notified by CBDT, some fields 'rationalised'

The policy-making body of the tax department said on Thursday that some fields have been "rationalised" in the latest ITRs forms.

Apr 05, 2018, 23:36 PM ISTI-T notices to 1.16 lakh individuals and firms for cash deposit of over Rs 25 lakh

The tax department has combed as many as 18 lakh people who had deposited junked 500 and 1000 rupee currency notes of over Rs 2.5 lakh each post demonetisation.

Nov 28, 2017, 13:57 PM ISTDemonetisation: I-T dept to issue notices to suspicious cash depositors

The people who have filed their returns will be examined against the amounts they have deposited during the period of demonetisation, so that we can see whether they have correctly disclosed their income or not, the CBDT chief said.

Nov 14, 2017, 20:08 PM ISTI-T returns don't suggest actual income of person, says Sessions Court

The couple was married in 1993 and was allegedly forced to leave her matrimonial house in April 2010. Katy had filed a criminal case against Nowzer under the Protection of Women from Domestic Violence Act.

Nov 13, 2017, 08:23 AM ISTIT dept to share vital data with MCA to nail down shell companies

The tax authorities will now relay audit reports of corporates and specific information from their I-T returns as also PAN data to the ministry of corporate affairs, as the government plans to crack down harder on shell companies.

Jul 27, 2017, 15:10 PM ISTCBDT notifies new scrutiny notices with e-facility for taxpayers

The CBDT has notified revised income tax scrutiny notices that will allow taxpayers to conduct their business with the taxman over the Internet without needing to visit the I-T office, hence reducing physical interface between them.

Jun 24, 2017, 11:47 AM ISTI-T dept issues 1.62 crore refunds worth Rs 1.42 lakh crore

The income tax department has issued refunds to the tune of Rs 1.42 lakh crore so far this fiscal till February 10, 41.5 percent higher than last year's.

Feb 13, 2017, 19:06 PM ISTCBDT warns penal action against those "drastically" altering ITR to revise income

Central Board of Direct Taxes (CBDT) on Wednesday issued strict warning to assessees who are trying to misuse the provision of revising I-T returns.

Dec 14, 2016, 14:01 PM ISTHurry up! Today is the last day to file your income tax returns

Tax returns for 2015-16 (assessment year 2016-17) were originally to be filed by July 31. But in view of the day-long strike at public sector banks, the deadline has been extended to August 5.

Aug 05, 2016, 08:50 AM IST'Don't treat earning below Rs 5 lakh from shares as biz income'

The move to make annual income of less than Rs 5 lakh made on equity trading as short-term capital gains would help reduce litigations and bring in more retail money into the stock markets.

Jan 19, 2016, 19:39 PM IST

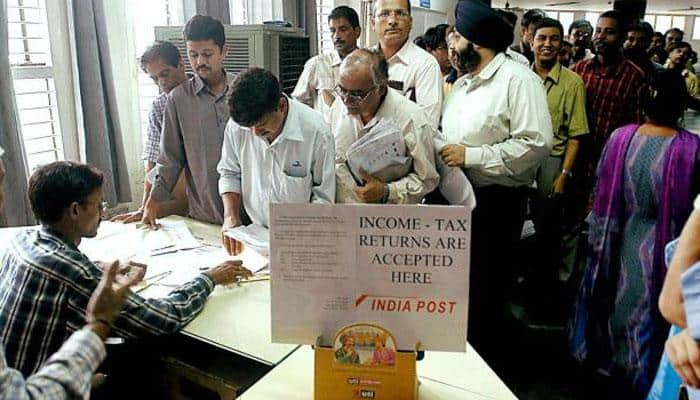

FinMin asks taxpayers to e-file I-T returns early

The Finance Ministry today asked taxpayers to file their I-T returns for 2015-16 early to avoid the rush towards the last date of August 31.

Jul 01, 2015, 21:16 PM ISTEnd of paper trail in e-filing of I-T returns; Aadhaar added

In a major step aimed at easing taxpayer grievances, CBDT on Friday announced that assessees filing I-T returns online will no longer have to send the paper acknowledgement by post as a new Aadhaar-based electronic verification code has been launched to authenticate this document.

Apr 17, 2015, 20:33 PM ISTI-T dept collects over Rs 3,500 crore from non-filers

The Income Tax department has issued over 20 lakh "intimations" and collected Rs 3,569 crore in the current financial year from those taxpayers who had either not filed their tax returns or did so incorrectly.

Mar 24, 2015, 16:27 PM IST