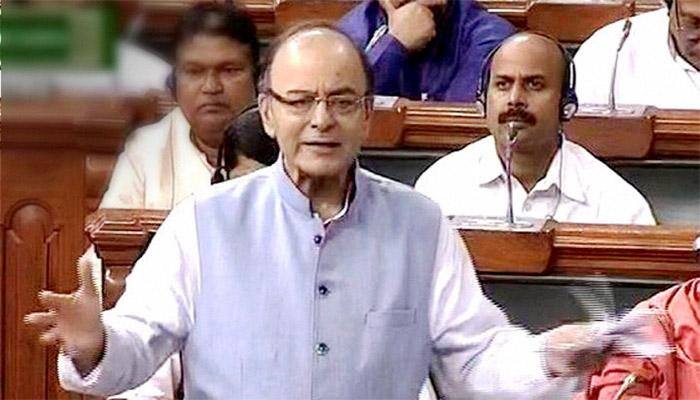

Rajya Sabha passes 4 GST bills; India's biggest tax reform inches closer to July rollout

India on Thursday inched closer to a unified tax regime with the Rajya Sabha passing four supplementary legislations which will enable the government to roll out the landmark Goods and Services Tax Bill on July 1.

Apr 06, 2017, 17:34 PM IST

Education, healthcare to be out of GST

Education, healthcare and pilgrimages will continue to be out of service tax net even under the GST?regime as the Centre is against giving any shock in the first year of the rollout by bringing in new services.

Apr 02, 2017, 13:02 PM ISTTaxes under GST ''to increase a bit'', says CBEC Chairman

While the effective rate of indirect taxes under the new Goods and Services Tax (GST) regime still remains unclear, as fitment in tax slabs is under way, the Central Board of Excise and Customs (CBEC) has said that taxes were likely to "increase a bit" from the current level.

Mar 14, 2017, 11:24 AM ISTWeb portal to guide traders on GST regime

A web portal to help traders and other stakeholders transition to the upcoming Goods and Services Tax (GST) regime has been launched.

Mar 07, 2017, 17:30 PM ISTCBEC asks tax officers to speed up GST migration

The Revenue Department has expressed "serious concern" over delay in migration of excise and service tax assessees to the new GST regime and asked field officers to complete the process by March 31.

Mar 03, 2017, 14:56 PM IST'4-tier GST rate may lead to classification disputes'

The four-tier GST rate structure will open up floodgates of classification disputes with tendency among businesses to demand lower rate for their goods or services, says a research paper.

Feb 13, 2017, 16:08 PM IST'GST Council may reduce tax slabs in future'

The GST Council may in future decide to reduce the tax slabs under the Goods and Services Tax regime after analysing the revenue garnered and the compensation payouts to states, a top official said Thursday.

Dec 08, 2016, 18:09 PM ISTGST rate on polluting items may be higher

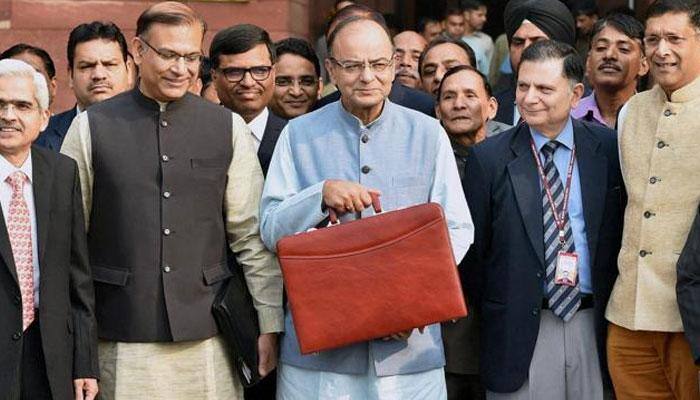

Within days of India signing the Paris Climate Treaty, Finance Minister Arun Jaitley on Friday said tax on environment unfriendly products will be "distinct" from others in the forthcoming GST regime so as to boost funds for climate financing.

Oct 14, 2016, 18:04 PM ISTGST regime: ClearTax to foray into return filing, launch app

To help clear confusion over return filing and tax planning under the impending GST regime, online tax filing portal ClearTax will act as an advisor to traders and businesses, assisting them in filing returns.

Oct 02, 2016, 11:17 AM ISTGovernment formally notifies GST Council

Government has formally notified the GST Council, which will decide on the tax rate, exempted goods and the threshold under the new taxation regime.

Sep 16, 2016, 13:54 PM ISTFinance Ministry mulling advancing Union Budget by a month

Union Budget has for decades been presented on last day of February, but this could soon change with the government mulling advancing it to January end so as to complete the budget exercise before the beginning of the new fiscal.

Aug 21, 2016, 13:28 PM ISTDespite politics, GST backbone on course for target date

Away from the public glare, a company set up by the government to create the logistical and IT backbone for the pan-India Goods and Services Tax (GST) regime will be ready to roll before the target date, as work didn`t stop even when political spats were delaying matters.

Aug 18, 2016, 16:43 PM ISTHow transactions of goods and services will be taxed under GST

Know how the transactions of goods and services will be taxed under Goods and Services Tax (GST) regime.

Aug 05, 2016, 12:07 PM IST'Travel may be costlier in short-term due to GST'

Consumers may have to pay more for travel and holidays in the short-term when GST is implemented, but in the long-run they will benefit following removal of duplication of tax incidences on hotels and airlines, according to travel service providers.

Aug 04, 2016, 22:01 PM ISTNasscom flags complex billing, invoicing issues in GST regime

The GST regime slated to be rolled out from April 1, 2017, should ensure that issues like complex billing and invoicing requirements and reverse charge on import of services do not impact the export competitiveness of the USD 110 billion sector, industry body Nasscom said on Thursday.

Aug 04, 2016, 21:59 PM ISTGST regime to have 8 forms for filing tax returns

The Joint Committee on Business Process for GST in relation to GST Return has suggested filing of a periodic e-return for Central GST, State GST and Integrated GST.

Oct 22, 2015, 15:09 PM ISTDon't abandon Dirext Taxes Code: Parl panel to Govt

Asking the government not to abandon the Direct Taxes Code (DTC), a Parliamentary panel on Friday said this new law needs to be enacted to replace the existing Income Tax Act, which it said was "very cumbersome" and prone to avoidable litigation.

Apr 24, 2015, 19:18 PM IST