Cabinet clears proposal to make GSTN 100% govt-owned company

GSTN Board will initiate the process for acquisition of equity held by the private companies.

Sep 27, 2018, 10:49 AM ISTGoM on GST Network to meet on Wednesday

This will be the sixth meeting of the Group of Ministers (GoM) after being set up in September 2017.

Jan 15, 2018, 17:27 PM IST43.67 lakh biz file initial GST returns for October

Around 56 percent of the registered taxpayers filed their GSTR-3B returns for October within due date.

Nov 21, 2017, 20:04 PM ISTBusinesses can revise GST transition claim form now

The functionality to fill the claim form was provided on the GSTN portal in August 2017.

Nov 10, 2017, 14:10 PM ISTCut GST for AC eateries, small businesses: Panel

Currently, manufacturers and restaurants with turnover up to Rs 1 crore pay GST under composition scheme at 2 percent and 5 percent respectively. The same for traders is 1 percent.

Oct 30, 2017, 08:55 AM ISTGovt will take about a year to stabilise GST: Hasmukh Adhia

He said the Goods and Services Tax (GST), which amalgamates more than a dozen central and state levies like excise duty, service tax and VAT, will take about a year to stabilise.

Oct 22, 2017, 14:58 PM ISTTraders are 'positive' about GST, need handholding: PM Modi

The prime minister also called for sustained efforts to boost digital payments and work towards a less cash society.

Sep 27, 2017, 18:56 PM ISTGST Council forms panel to oversee technical glitches in filing returns

The return filing date deadline of GSTR-1 for July, that was to end on Sunday, has also been extended by a month till October 10.

Sep 09, 2017, 20:14 PM ISTStates red flag problem faced by traders on GSTN portal

The 21st meeting of the GST Council is being held here to discuss technology glitches in GSTN portal, imposition of higher cess on luxury and SUV cars and reduction tax rates on aboout two-dozen items.

Sep 09, 2017, 13:27 PM ISTGST Council meet begins in Hyderabad

This is the third meeting of the GST Council since the launch of the Goods and Services Tax on July 1, and the 21st since it was set up in September last year.

Sep 09, 2017, 12:57 PM ISTGST Council may fix tax anomalies, cess hike on cars today

It will also take up IT related issues in the GST network which has faced glitches.

Sep 09, 2017, 09:50 AM ISTGet ready for first filing deadline, GST chief says

Navin Kumar, chairman of the GST Network, also said barely half of the 34 service providers accredited to help firms bulk-file invoices online had received approval to go live.

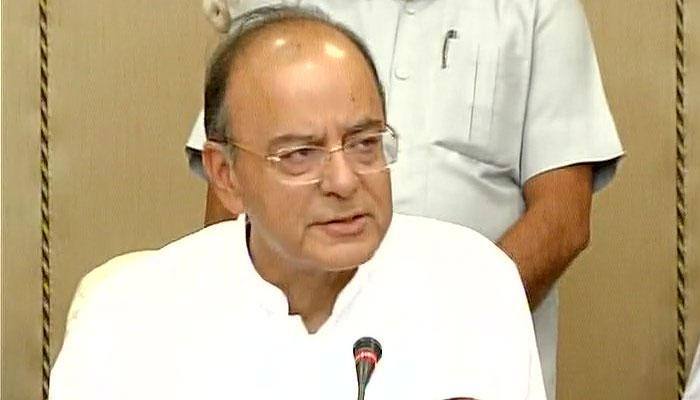

Aug 09, 2017, 13:10 PM ISTFinance Minister indicates scope for rationalisation of rates under GST

He gave the indication in the Lok Sabha while replying to a debate on the Central Goods and Services Tax (Extension to Jammu and Kashmir) Bill, 2017 and the Integrated Goods and Services Tax (Extension to Jammu and Kashmir) Bill, 2017 which were later passed by a voice vote.

Aug 02, 2017, 20:31 PM ISTSubdued demand may force relook at GST composition scheme

With just about one lakh of 70 lakh businesses opting for GST Composition Scheme, tax authorities are reviewing why the scheme that allowed such entities to pay a fixed 1-5 percent tax, has not clicked.

Jul 30, 2017, 16:54 PM ISTGSTN portal to be ready for invoice uploading from today

Businesses can start uploading their sale and purchase invoices generated post July 1 on the GSTN portal from Monday.

Jul 24, 2017, 08:55 AM ISTRental income beyond Rs 20 lakh to attract GST

Revenue Secretary Hasmukh Adhia said that if the house property is rent out for shop or office purpose, no Goods and Service Tax (GST) will be levied up to Rs 20 lakh.

Jul 10, 2017, 23:33 PM ISTGSTN launches Excel template for filing GST returns

The Excel template, comprising eight worksheets, is part of GST Network's approach to make tax compliance easy and convenient for taxpayers and also reduce the time of compliance.

Jun 30, 2017, 17:55 PM ISTSoftware testing complete, ready for smooth GST rollout: GSTN

The GSTN portal has also started accepting registrations from new taxpayers from June 25 even as the process of migration of existing taxpayers is already on.

Jun 27, 2017, 20:30 PM IST

GST registrations for e-commerce, new companies to begin on June 25

Ecommerce operators and TDS deductors will be able to register with GST Network beginning June 25, when the portal re-opens for fresh registration.

Jun 23, 2017, 17:36 PM ISTGST to rollout on July 1, return filing rules relaxed for July-August

The GST Council on Sunday relaxed return filing rules for businesses for the first two months of the rollout of the new indirect tax regime even as it stuck to the July 1 launch date.

Jun 18, 2017, 19:15 PM IST