Bandhan Bank Customers Can Now Pay Direct Taxes Online --All You Want To Know

Bandhan Bank customers can now pay their Direct Taxes through the Bank’s Retail Internet Banking, Corporate Internet Banking and Payment Gateway.

Jun 28, 2024, 12:05 PM ISTDirect Tax Collections At 80.23% Of Total Revised Estimates Of Direct Taxes For FY 23-24

Refunds amounting to Rs. 2.77 lakh crore have been issued during 1st April, 2023 to 10thFebruary, 2024.

Feb 12, 2024, 09:25 AM ISTDecoding Budget Terms: What Is Direct Tax? Definition, Types, And More - Check Here

Direct tax is a straightforward concept -- it is a tax paid directly by individuals or organizations to the government based on their earnings.

Jan 11, 2024, 18:14 PM ISTNet Direct Tax Collections Grow 18% To Rs 16.61 Lakh Cr In FY23, Exceeding RE

The provisional figures of direct tax collections for the financial year (FY) 2022-23 show that net collections are at Rs 16.61 lakh crore.

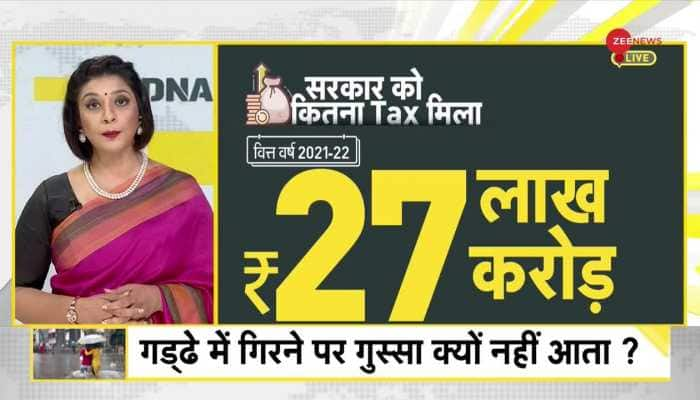

Apr 03, 2023, 21:19 PM ISTDNA: What facilities government has provided in lieu of taxes?

In the financial year 2021-22, the Government of India had received Rs 27 lakh crore as tax. Of these, Rs 14 lakh crore was received by the government in the form of direct tax and Rs 13 lakh crore in the form of indirect tax. But what facilities government has provided in return?

Jul 07, 2022, 01:42 AM ISTDirect tax collections expected to breach Rs 12.50 lakh crore target: CBDT chairman

Multiple reasons like "easing" of tax compliance processes for tax payers and enhanced ability of the taxman in data processing were cited by him for mopping up these high-volume of collections under two major heads -- corporate tax and personal income tax.

Feb 03, 2022, 16:23 PM ISTDirect tax collections jump over 100% so far in FY22 despite COVID-19 led economic disruption

Corporation Tax (CIT) at Rs 74,356 crore (net of refund) and Personal Income Tax (PIT) including Security Transaction Tax (STT) at Rs. 1,11,043 crore (net of refund) compromise the net direct tax for FY22.

Jun 16, 2021, 17:02 PM ISTGovernment extends certain timelines in light of the raging COVID-19 pandemic

It has also been decided that the time for payment of amount payable under the Direct Tax Vivad se Vishwas Act, 2020, without an additional amount, shall be further extended to 30th June, 2021. Notifications to extend the above dates shall be issued in due course.

Apr 24, 2021, 12:54 PM ISTNet Direct Tax collections for FY 2020-21 at Rs 9.45 lakh crore

Refunds amounting to Rs. 2.61 lakh crore have been issued in the F.Y. 2020-21 as against refunds of Rs. 1.83 lakh crore issued in the F.Y. 2019-20, marking an increase of approximately 42.1% over the preceding Financial Year.

Apr 09, 2021, 18:04 PM ISTFaceless assessment, taxpayers' charter, faceless appeal service: Here is what Income Tax filers must know

Know all about Faceless assessment, taxpayers' charter and faceless appeal service.

Aug 18, 2020, 10:21 AM ISTPM Narendra Modi launches platform for Transparent Taxation, says new tax platform will expedite tax refunds

PM Modi said that faceless assessment and taxpayers' charter are being implemented from today while faceless appeal service will be available from September 25.

Aug 13, 2020, 12:47 PM ISTFaceless assessment, taxpayers' charter implemented from today; faceless appeal service will be available from September 25: PM Modi

The faceless scrutiny assessment has been devised for greater transparency, greater efficiency and accountability.

Aug 13, 2020, 12:27 PM ISTPM Narendra Modi to launch platform for Transparent Taxation today; FM Sitharaman says it is important step for Indian taxation

Union Minister of Finance and Corporate Affairs, Nirmala Sitharaman and Minister of State for Finance and Corporate Affairs, Anurag Singh Thakur will also be present on the occasion.

Aug 13, 2020, 09:29 AM ISTPM Narendra Modi to launch platform for Transparent Taxation on August 13

Union Minister of Finance and Corporate Affairs, Nirmala Sitharaman and Minister of State for Finance and Corporate Affairs, Anurag Singh Thakur will also be present on the occasion.

Aug 12, 2020, 14:56 PM ISTGovernment open to suggestions for better implementation of Vivad Se Vishwas scheme: CBDT chief PC Mody

The CBDT chairman clarified the doubts by answering frequently asked questions and said that no scheme could be conceived with all the perfections, so also could be this scheme.

Apr 07, 2020, 00:16 AM ISTNumber of e-filing of ITR increase 18.65% in AY 2018-19

The number of e-Returns submitted for Assessment Year 2018-19 is 6,49,39,586 as against 5,47,30,304 e-Returns filed for the Assessment Year 2017-18.

Jun 25, 2019, 14:17 PM ISTI-T dept issued Rs 64,700-cr refund between Apr 1-Jun 18, 2019: Sitharaman

In a written reply to a question in the Lok Sabha, she said over 6.49 crore electronic returns were submitted for assessment year 2018-19 (financial year 2017-18), up 18.65 per cent from over 5.47 crore in assessment year 2017-18.

Jun 24, 2019, 14:54 PM ISTDirect tax kitty grows 19% to Rs 6.95 lakh crore in Apr-Jan period

Collections for Corporate Income Tax showed a growth of 19.2% and that for Personal Income Tax came at 18.6%.

Feb 09, 2018, 21:23 PM ISTDecoding the direct tax law –Several lessons learnt from GST

In an interview to Zee Media Digital, Chetan Chandak, Head of Tax research, H&R Block India shares his view on Direct Taxes, its impact and implications of overhauling it.

Dec 05, 2017, 14:05 PM ISTAfter demonetisation and GST, Modi govt sets sight on new Direct Tax law

The move, which is aimed to make direct taxes - income and corporate - simple, comes ahead of BJP-led government's last full Budget.

Nov 23, 2017, 10:05 AM IST