New Delhi: Finance Minister Nirmala Sitharaman's Budget 2024 announcement has once again put the spotlight on property owners. The removal of Indexation benefits has thus stirred the debate about whether investment returns in Real estate will still be as lucrative or not.

Coupled with that, will lowering of Long Term Capital Gains (LTCG) from 20 percent to 12.5 percent without getting any indexation benefit do any good to home buyers or investors?

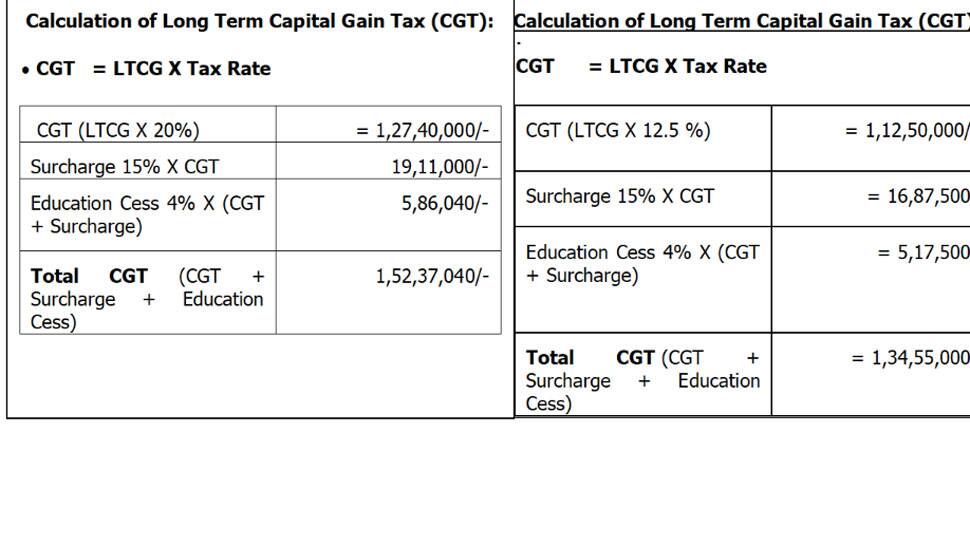

Sunil Tyagi, Maging Partner, Zeus Laws, in a candid conversation with Reema Sharma of Zee News has shared a detailed calculation on both the scenario --Indexation and new LTCG -- when a house is bought before 2001 and after 2001. Here's all you want to know.

When a house / immovable property is sold the profit / gain from such sale can be long-term or short-term.

What is Short-Term Capital Gains (STCG)?

If a house is sold within a period of 24 months from the date of its purchase, then any profits / gains from the sale of the house will be treated as short-term capital gain, and the amount of short-term capital gain which will be treated as a part of seller’s total income and will be taxed as per the existing tax slab rates as applicable to such Seller.

What is Long-Term Capital Gains (LTCG)

If a house is sold after a period of 24 months from the date of its purchase, then any profits / gains from the sale of the house will be treated as long-term capital gain, and the amount of long-term capital gain will be taxed @ long-term capital gain tax applicable in the financial year in which such sale has been affected.

What is Indexation?

Indexation is the process of adjusting the purchase price of the immovable property for inflation.

Prior to the changes in the Capital Gain Tax regime introduced in the 2024 Budget, the benefit of indexation (i.e., adjusting the value of property as per current market scenario) was available, and the Long-Term Capital Gains was taxable at 20 percent.

In the revised Capital Gain Tax regime introduced in the 2024 Budget, the tax on Long-Term Capital Gains has been reduced from 20 percent to 12.5 percent for property sales, however, the benefit of indexation has been discontinued. In cases of properties acquired prior to 01.04.2001, the fair market value as on 01.04.2001 shall be considered as Deemed Cost for computing capital gains tax.

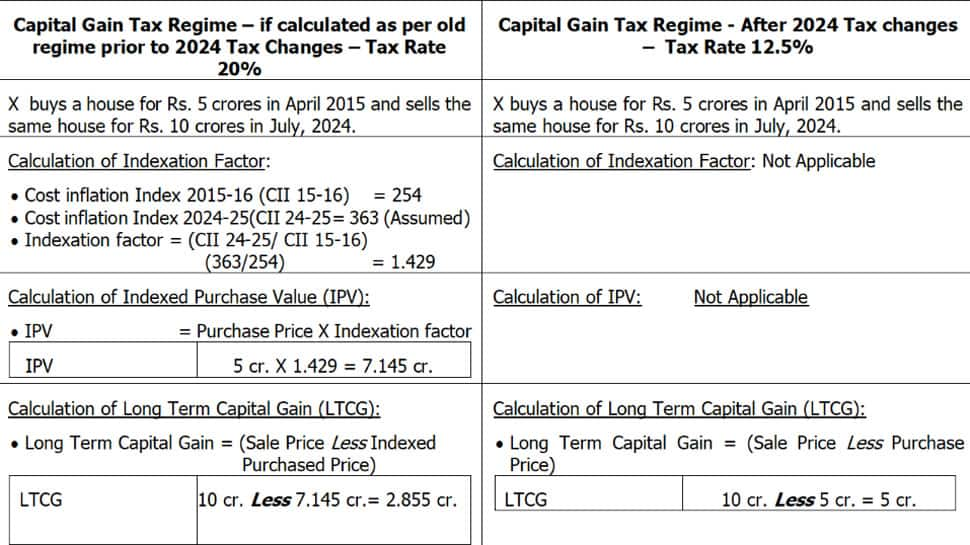

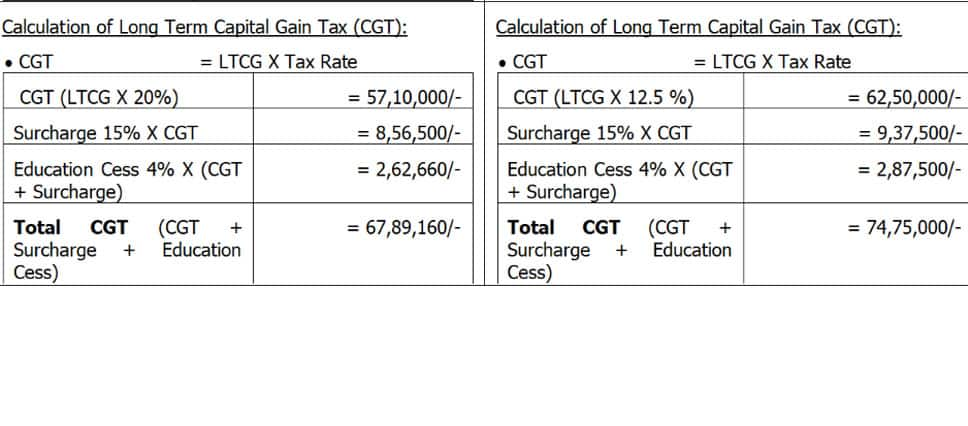

Case 1 : Calculation of Long Term Capital Gain tax under old and new Capital Gain Tax Regime in case a house is purchased after year 2001:

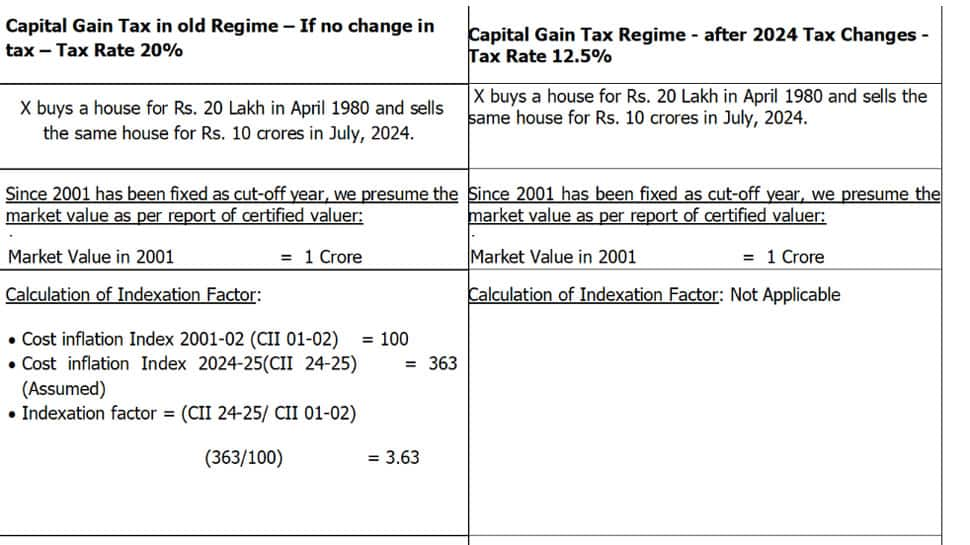

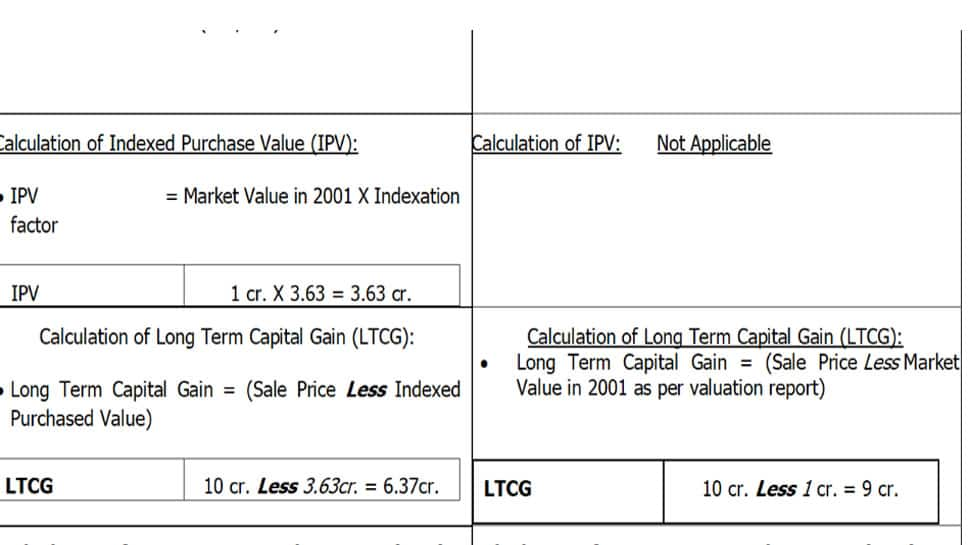

Case 2: Calculation of Long Term Capital Gain tax under old and new Capital Gain Tax Regime in case a house is purchased before year 2001

Meanwhile, Prashant Thakur, Regional Director & Head – Research, ANAROCK Group told Zee News, "The elimination of indexation benefits might cause a decrease in investor interest as indexation adjusts the buying price to account for inflation, thereby decreasing the capital gains tax on property sales. Without this advantage the tax burden rises, making real estate investment less appealing. This change could have an impact on high value properties potentially leading to a decrease in demand for such properties."