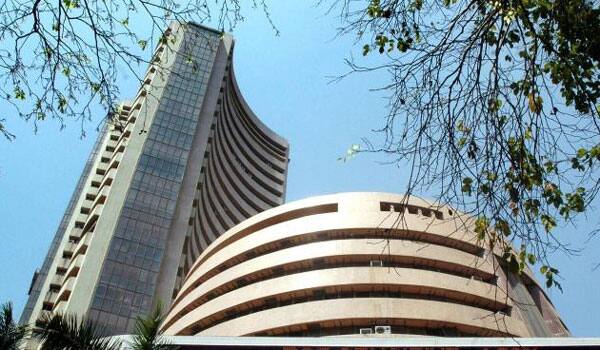

Mumbai: In a listless trading Monday, the Sensex closed with a marginal loss of over 31 points at 26,595 on the first trading day of 2017 as banking stocks felt the heat due to worries that the lending rate cuts will hit their bottom line.

Investors started taking profit that made mood downbeat.

There was accelerated selling after the manufacturing sector contracted in December, hit hard by demonetisation, and fresh weakness in the rupee. The Nikkei Markit India Manufacturing Purchasing Managers' Index (PMI) fell to 49.6, down from 52.3 in November.

Opening on a weak note, the Sensex shuttled between 26,720.98 and 26,447.06 and settled lower 31.01 points, or 0.12 percent, at 26,595.45.

The gauge had gained 415.78 points in the previous two straight sessions.

The 50-share Nifty edged down by 6.30 points, or 0.08 percent, to close at 8,179.50. It shuttled between 8,212 and 8,133.80 intra-day.

"The new year got off to a rocky start, with markets trying to gauge the impact of the Prime Minister's credit sops and bank rate cuts. Lenders, including NBFCs, recovered though and the weak PMI figures could not rein in the pullback, presumably having already priced in soft macros pertaining to the note ban period," said Anand James, Chief Market Strategist, Geojit BNP Paribas Financial Services.

In the banking space, HDFC Ltd emerged as the top loser by falling 3.45 percent, followed by SBI 2.46 percent and ICICI Bank 1.37 percent. Axis Bank shed 0.73 percent and HDFC Bank 0.57 percent. Other prominent names that lost were Infosys, GAIL, Cipla, Wipro, HUL, NTPC and TCS.

Most global stocks, including those in Asia and Europe, were closed today for the New year. The near-absence of overseas cues meant investors scrambled for direction.

In contrast, investors created fresh positions in second-line stocks, with small-cap and mid-cap indices beating the Sensex with gains of 1.20 percent and 0.83 percent, respectively.

Bajaj Auto fell 1 percent after a 22 percent decline in total sales in December. But the largest car-maker Maruti Suzuki gained 2.69 percent even as it reported 1 percent decline in total sales for December 2016. M&M rose 3.42 percent after 9 percent increase in total tractor sales at 14,047 units while Tata Motors climbed 3.37 percent.

Stocks of realty companies stole buyers' imagination after Prime Minister Narendra Modi announced on Saturday that loans of up to Rs 9 lakh under the new scheme of Pradhan Mantri Aawas Yojana will receive interest subvention of 4 per cent and those of up to Rs 12 lakh will get 3 percent waiver.

Unitech, DLF Ltd, HDIL, Oberoi Realty, Sobha, Godrej Properties, Indiabulls Real Estate and Omaxe soared up to 6.65 per cent.

The FII sell-off continued as foreign funds net sold shares worth Rs 585.64 crore and domestic institutional investors (DIIs) bought worth a net Rs 824.84 crore on the last trading day of 2016 on Friday, provisional data showed.

Stocks of state-run oil marketing companies such HPCL, BPCL and IOC ended higher by up to 1.78 per cent following hike in fuel prices.

Sectorally, the BSE banking sector index suffered the most by falling 1.18 percent, followed by IT (0.33 percent) and technology (0.15 percent) while realty rose 4.32 percent and auto 1.95 percent.

"There were little signs from global markets as well, with several countries still shut for new year festivities. But the week ahead is expected to be flush with more macro releases and should ensure volatility," added James.

Of the 30 scrips in the Sensex pack, 13 closed lower, 15 ended higher while 2 remained unchanged.

The market breadth remained positive as 1,918 stocks ended higher, 797 declined while 109 remained unchanged.

The total turnover on BSE amounted to Rs 2,514.83 crore, lower than Rs 3,136.27 crore registered previously.