1 February 2020, 14:17 PM

The FM further added that the Income Tax Act will be amended to allow faceless appeals against tax orders on lines of faceless assessment.

1 February 2020, 13:44 PM

1 February 2020, 13:43 PM

Finance Minister Nirmala Sitharaman ends her budget speech.

1 February 2020, 13:37 PM

Custom duty on footwear and furniture to be reduced : FM

1 February 2020, 13:35 PM

Under Vivad Se Vishwas Scheme, taxpayer to pay only amount of disputed tax, will get complete waiver on interest and penalty, if scheme is availed by March 31, 2020 - FM

1 February 2020, 13:34 PM

To ease allotment of PAN, new process of instantly allotting PAN through Aadhaar will be brought: FM

1 February 2020, 13:33 PM

Govt extends additional Rs 1.5 lakh tax benefit on interest paid on affordable housing loans to March 2021.

1 February 2020, 13:31 PM

Turnover threshold for audit of MSMEs to be increased from 1 crore to 5 crore rupees, to those businesses which carry out less than 5% of their business in cash - FM

1 February 2020, 13:29 PM

Nirmala Sitharaman brings new direct tax dispute government scheme in Union budget 2020-21.

1 February 2020, 13:29 PM

Date of approval of affordable housing projects for availing tax holiday on profit earned by developers extended by 1 year: FM.

1 February 2020, 13:28 PM

Tax on Cooperative societies proposed to be reduced to 22 percent plus surcharge and cess, as against 30 per cent at present, says FM.

1 February 2020, 13:26 PM

To boost startups, tax burden on employees due to tax on Employee Stock Options to be deferred by five years or till they leave the company or when they sell, whichever is earliest - FM

1 February 2020, 13:26 PM

Concessional corporate tax cut to be extended to new domestic companies engaged in power generation - FM

1 February 2020, 13:25 PM

Expansion of National Gas Grid from 16,200 km to 27,000 km along with reforms to deepen gas markets, enable ease of transactions and transparent price discovery: FM

1 February 2020, 13:23 PM

Concessional corporate tax cut to be extended to new domestic companies engaged in power generation - FM

1 February 2020, 13:21 PM

Around 70 of more than 100 income tax deductions and exemptions have been removed, in order to simplify tax system and lower tax rates: FM

1 February 2020, 13:17 PM

Divendend distribution tax abolished: FM

1 February 2020, 13:13 PM

Substantial tax benefit will accrue to individual tax payers under the new personal income tax regime: FM

1 February 2020, 13:10 PM

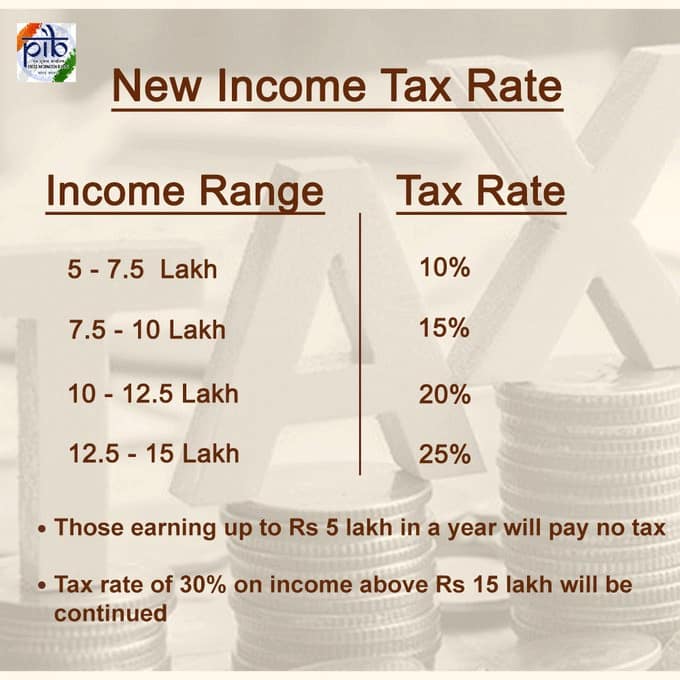

New income tax rate is optional without exemptions: FM

1 February 2020, 13:09 PM

25 % tax for income between 12.5 lakh to 15 lakh: FM

1 February 2020, 13:08 PM

20 % tax for income between 10 lakh to 12.5 lakh : FM

1 February 2020, 13:07 PM

15 % tax for income between 7.5 lakh to 10

1 February 2020, 13:02 PM

Tax rate reduced to 10 % from prevailing 20% from income between 5 lakh to 7.5 lakh: FM

1 February 2020, 13:00 PM

Key Budget takeaways:

- Govt to raise funds via listing of LIC

- Deposit insurance raised to Rs 5 lakh

- FY21 fiscal deficit target pegged at 3.5% of GDP

1 February 2020, 12:56 PM

Normal GDP growth pegged at 10 percent: FM

1 February 2020, 12:55 PM

Govt to raise fund from LIC IPO: FM

1 February 2020, 12:53 PM

Govt to launch IPO for LIC, says FM

1 February 2020, 12:53 PM

Need for greater private capital in banks, says FM

1 February 2020, 12:50 PM

Balance govt holding in IDBI banks to be sold to pvt retail investors: FM

1 February 2020, 12:48 PM

Fiscal deficit target revised to 3.8% FY 20, 3.5 % for FY 21 : FM

1 February 2020, 12:47 PM

NBFC's will allow invoice financing to MSMEs : FM

1 February 2020, 12:44 PM

30,757 crore rupees for Union Terrritory of Jammu & Kashmir 5,958 rupees for Union Terrritory of Ladakh - FM

1 February 2020, 12:42 PM

Govt will introduce robust mechanism to monitor banks: FM

1 February 2020, 12:42 PM

Insurance cover for bank depositor increased from 1 lakh to Rs 5 lakh: FM

1 February 2020, 12:40 PM

Rs 100 crore allocated for the celebration of 75th Independence of India : FM

1 February 2020, 12:38 PM

India will host G20 presidency in 2022: FM

1 February 2020, 12:37 PM

Our govt remains committed to taking measures to ensure that our taxpayers are free from tax harassment of any kind : FM

1 February 2020, 12:35 PM

Tax-payer charter to be institutionalised: FM

1 February 2020, 12:34 PM

Conventional energy meters to be replaced by prepaid smart meters in the next three years. Pre-paid meters (smart meters) will give consumers freedom to choose suppliers: FM

1 February 2020, 12:32 PM

FM allots Rs 3,100 crore for Ministry of Culture

1 February 2020, 12:31 PM

National security is government's top priority, says FM

1 February 2020, 12:29 PM

Shut thermal power plants if emission in more: FM

1 February 2020, 12:25 PM

Rs 4,400 crore incentives for cities that promote clean air: FM

1 February 2020, 12:24 PM

'Ayushman Bharat' hospital in 100 more districts : FM

1 February 2020, 12:21 PM

Five archaeological sites will be set up with museums on site in Rakhi Gadi in Haryana, Hastinapur in UP, Dholavira in Gujarat, Shivsagar in Assam and Adichanallur in Tamil Nadu. A tribal museum will be set up in Ranchi, Jharkhand. Maritime site will be set up in Lothal: FM

1 February 2020, 12:20 PM

Rs 85000 crore for SC-STs and OBC for FY 2020-21.

1 February 2020, 12:18 PM

Rs 35,000 cr for nutrition scheme: FM

1 February 2020, 12:16 PM

'Beti bachao Beti padaho' a great success: FM

1 February 2020, 12:15 PM

Enrollment of girls in school higher than boys: FM

1 February 2020, 12:13 PM

Gross enrollment ratio of girls higher than boys: FM