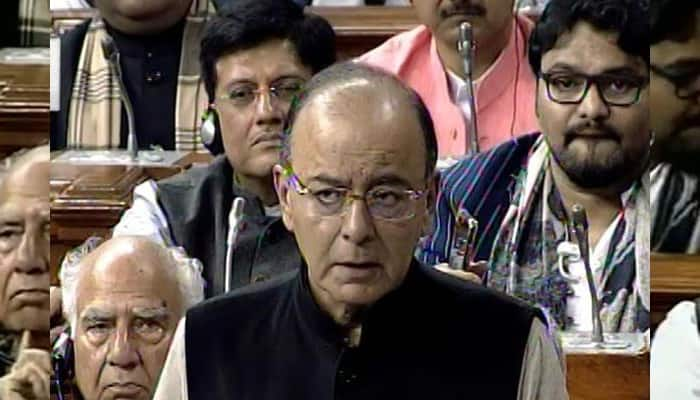

New Delhi: Highlights of the Union budget for 2017-18 presented by Finance Minister Arun Jaitley in parliament on Wednesday:

* Tax rates halved to 5% for income of Rs 2.5-5 lakh, tax

Slabs unchanged

* 10% surcharge on people earning between Rs 50 lakh-1 cr

* 15% surcharge on annual income above Rs 1 cr to continue

* Cash transactions above Rs 3 lakh to banned

* Corporate tax for SMEs with turnover up to Rs 50 cr cut

To 25%; 96% companies to benefit

* Customs duty of LNG halved to 2.5%

* Fiscal deficit pegged at 3.2% next year, 3% in FY'19

* Political parties barred from accepting cash donation

Beyond Rs 2,000 per individual

* They can receive donations via cheques, electronic mode;

Electoral bonds to be issued by RBI

* Aadhaar-based health cards for senior citizens; a scheme

For them to ensure 8 pc guaranteed returns

* FIPB to be abolished; further FDI policy liberalisation

* Government to have time-bound procedure for CPSE listing

* Railway PSUs -- IRCTC, IRFC, IRCON to be listed

* Payment Regulatory Board to be set up within RBI to

Regulate digital payments

* Negotiable instruments Act to be amended to deal with

Cheque bounce cases

* Legislative changes to confiscate of assets of economic

Offenders who flee country

* Demonetisation bold, decisive measure; to help GDP

Growth, taxes mop up to rise

* Effect of demonetisation not to spill over to next year

* GST, demonetisation 'tectonic changes' for economy

* Service charges on e-tickets booked via IRCTC waived

* Capital expenditure of Railway fixed at Rs 1.31 lakh cr

* Rail safety fund of Rs 1 lakh cr over 5 years, unmanned

Level crossing to be eliminated by 2020

* Budget based on 3 agenda -- Transform, Energise, Clean

India (TECIndia).

* 2 new schemes -- Referral Bonus for individuals, Cash

Back for merchants -- under BHIM app soon

* Aadhaar enabled payment system for merchants shortly

* Bill on curtailing menace of illicit deposit schemes in

Offing

* Fiscal deficit for this fiscal at 3.2%, down from budget

Estimate of 3.5%

* FRBM Committee recommends 3% fiscal deficit for 3 years

* Rs 10,000 cr to be provided to banks for recapitalisation

* Trade Infrastructure for Export Scheme (TIES) to be

Launched next fiscal

* Simple 1 page form to be filled by individuals having

Taxable income of Rs 5 lakh

* Excise duty on cigars, cheroots hiked to 12.5% or Rs 4006

Per thousand

* Excise duty on pan masala hiked to 9% from 6%; on raw

Tobacco raised to 8.3% from 4%

* Parts used for manufacture of LED lights to attract basic

Customs duty of 5% and CVD of 6%

* Solar tempered glass used for manufacture of solar

Cells/panels exempted from customs duty

* Customs duty on printed circuit board for manufacture of

Mobile phones hiked to 2% from nil

* Threshold for audit of businesses opting for presumptive

Income doubled to Rs 2 cr

* Under presumptive taxation for professionals up to Rs 50

Lakh advance tax can be paid in one instalment

* Scope of domestic transfer pricing restricted to entities

Availing profit linked deduction

* Presumptive tax would be 6% for SMEs with Rs 2 crore

Turnover opting for digital payment, 8% for others

* MAT credit will be allowed to be carried forward for 15

Years, as against 10 years at present

* Lending target under Mudra Yojana set at Rs 2.44 lakh cr

* Computer Emergency Response Team for Financial Sector to

Be established

* Extensive reach out programme for GST to be launched on

April 1.

* India a bright spot in world economic landscape, to be

Engine of global growth.

With PTI Inputs